Auto logout in seconds.

Continue LogoutExecutive Summary

Medicare Part A, also known as Hospital Insurance, is a type of coverage funded by CMS under its fee-for-service reimbursement model. It covers inpatient hospital care (at short-term acute, long-term acute, and critical access hospitals), skilled nursing facility (SNF) care, inpatient rehabilitation facilities (IRFs), hospice care, and home health (HH) services.

CMS is incentivizing providers to deliver higher standards of care by implementing various inpatient pay-for-performance programs that impact providers’ Medicare Part A payments. In several instances, commercial insurers have modeled their payment systems to hospitals and employed physicians on Medicare Part A.

Why is Medicare Part A a key issue for providers?

Under Medicare Part A, providers are typically paid through a fee-for-service structure. CMS is gradually shifting traditional fee-for-service Medicare payments to provider performance on quality and costs through different inpatient reimbursement programs. Since a large proportion of inpatient providers’ revenue comes from Medicare Part A, providers must prioritize cost containment and quality initiatives to maintain positive margins and remain competitive.

How does Medicare Part A work?

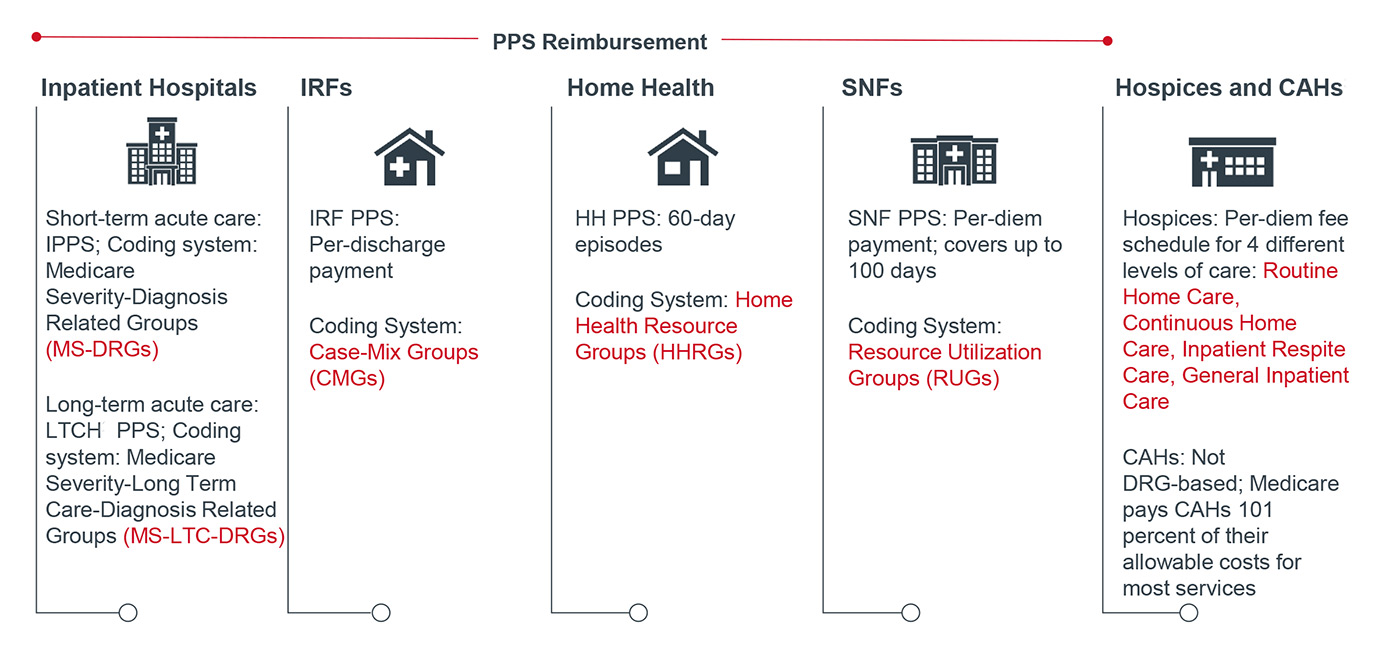

The core of Medicare Part A uses a Prospective Payment System (PPS) in which provider institutions are reimbursed based on a predetermined, fixed rate for a specified unit of service, such as hospital stay or episode of care. The payment amount for a particular episode of care is classified under a coding system that considers the patient’s clinical condition and the type of services furnished at a particular provider facility.

Medicare then adjusts the fixed rate by considering the patients’ clinical complexity and provider-specific factors, such as cost of living, case mix, and wage index. Overall, codes that typically correspond to more intense levels of care and resource utilization, as well as longer lengths of stay, gain higher payments from CMS.

Care Settings Covered Under Medicare Part A

How does Medicare Part A affect providers?

Clinical

In order to maximize CMS reimbursement under Medicare Part A, providers must prioritize patient safety, clinical effectiveness, care coordination, and cost efficiency. To achieve high quality outcomes, especially on key metrics, such as infection, readmission and mortality rates, and cost per case, providers will need to focus their clinical efforts on standardizing care protocols and reducing unnecessary care variation.

Financial

Medicare reimbursement rates are generally lower than commercial payers’ rates, and Medicare has implemented numerous cuts to inpatient payment rates over the past few years. At the same time, the Medicare population is growing dramatically as baby boomers age into the program. This confluence of factors poses a unique challenge for hospital profitability.

As margin pressures increase, hospitals are increasingly focused on streamlining purchasing decisions, improving operational efficiency, and maintaining appropriate documentation. Pay-for-Performance programs also impact Medicare Part A reimbursement by introducing financial risk for cost and quality measures. For example, under the Hospital and SNF Value-Based Purchasing Programs, providers are assessed on clinical quality metrics that range from safety, clinical care, person and community engagement, and cost reduction. Based on their performance on those metrics, providers may receive bonuses or penalties.

Operational

Medicare Part A introduces several reporting and documentation burdens for providers as they must report quality measures to receive a percentage increase in payment. Moreover, providers must accurately capture the acuity of their patient population to secure appropriate payment adjustments from CMS for serving a complex case mix.

Therefore, it has become imperative for providers to set up robust data tracking and coding infrastructure. Providers must also communicate effectively with other providers along the continuum of care, especially post-acute caregivers, to reduce readmissions and infection rates for complex, high-utilization patients.

How might Medicare Part A impact provider-supplier sales relationships?

Medicare Part A will push providers to collaborate more with suppliers and service firms to achieve cost containment and quality improvement goals. Providers will seek assistance in three major areas:

Offer IT expertise: Vendor partners can help develop comprehensive quality reporting tools to track complicated clinical quality, cost, and patient-oriented measures. Clinical decision support and data analytics can help providers make nationally-compliant and evidence-based treatment decisions for their patients. Providers will also require support in setting up interoperable IT software to efficiently transmit vital patient information across different sites of care and help with medication reconciliation.

Prove product ROI: In order to reduce cost variation, providers will look to standardize their medical products, especially drugs and medical devices. Suppliers must establish value by providing real-world evidence and compare effectiveness research to command a premium for their products.

Adapt quickly to provider needs: Since CMS updates inpatient payments every fiscal year, providers will need to be flexible in their strategies for enhancing quality and lowering overall costs to remain competitive. Thus, vendors should also be nimble in their sales, marketing, and product tactics to serve their provider clients more effectively.

Conversation starters with provider leadership

1. What kind of quality reporting and tracking difficulties are you currently facing?

2. In what ways are you looking to improve or sustain cost and quality outcomes?

3. What is your strategy for improving care coordination with providers at other care settings?

Don't miss out on the latest Advisory Board insights

Create your free account to access 1 resource, including the latest research and webinars.

Want access without creating an account?

You have 1 free members-only resource remaining this month.

1 free members-only resources remaining

1 free members-only resources remaining

You've reached your limit of free insights

Become a member to access all of Advisory Board's resources, events, and experts

Never miss out on the latest innovative health care content tailored to you.

Benefits include:

You've reached your limit of free insights

Become a member to access all of Advisory Board's resources, events, and experts

Never miss out on the latest innovative health care content tailored to you.

Benefits include:

This content is available through your Curated Research partnership with Advisory Board. Click on ‘view this resource’ to read the full piece

Email ask@advisory.com to learn more

Click on ‘Become a Member’ to learn about the benefits of a Full-Access partnership with Advisory Board

Never miss out on the latest innovative health care content tailored to you.

Benefits Include:

This is for members only. Learn more.

Click on ‘Become a Member’ to learn about the benefits of a Full-Access partnership with Advisory Board

Never miss out on the latest innovative health care content tailored to you.