Auto logout in seconds.

Continue LogoutAdvisory Board recently conducted a survey of strategic and analytics leaders at 250 provider organizations to learn about how those organizations are currently using and plan to use AI. The survey asked many of same questions asked in a similar survey conducted in 2018, allowing us to compare how provider organizations’ perspective has evolved. Explore our five key insights to learn more about how attitudes have shifted and where things stand for a new era of analytics and AI.

About this survey

In January 2022, we surveyed 251 provider organizations across the U.S to explore analytics trends in the current health care landscape. The goals of the survey included:

- Explore current and planned use of health care analytics

- Understand how and when analytics and AI applications are built, staffed, and deployed

- Determine what key barriers exist and how analytics and AI fit within organizational strategy and future vision

From our aggregate data, we also segmented across a variety of cohorts, including organizations by size (by annual population served/covered) and type. The n-values of those are detailed below:

Organization size:

- Small organizations (0-10K+ 11-100K): 91 respondents

- Mid-size organizations (101-250K + 251K-1M): 95 respondents

- Large organizations (1.1-2.5M + 2.6-10M +11-25M + 26-100M): 62 respondents

Organization type:

- Health system (multiple hospitals): 91 respondents

- Hospital (independent): 40 respondents

- Academic Medical Center (AMC): 11 respondents

- Physician Medical Group: 74 respondents

- Community hospital: 12 respondents

- Clinically integrated networks & integrated delivery networks: 21 respondents

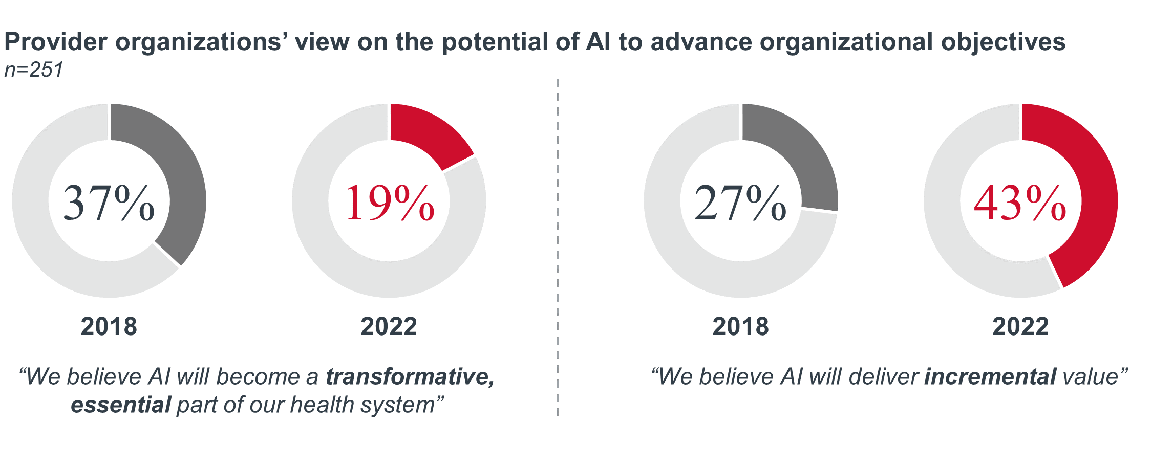

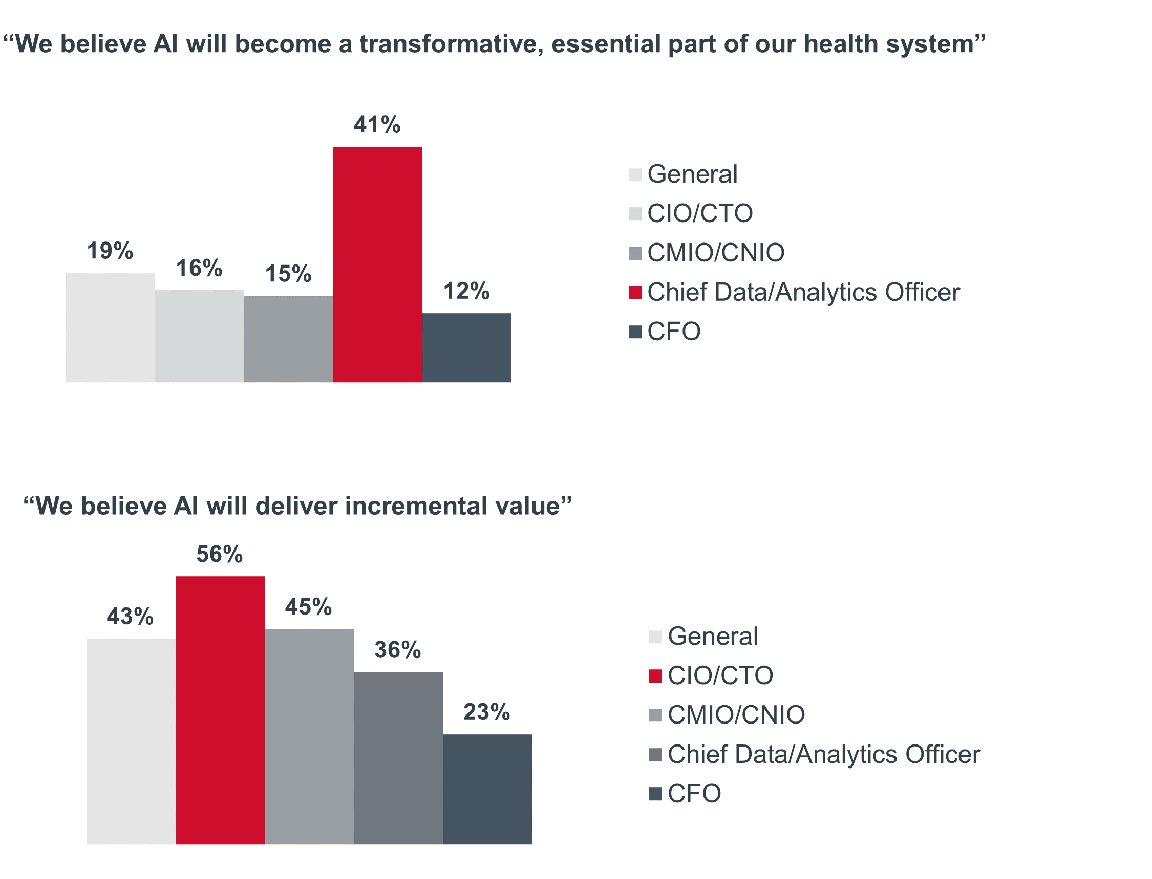

While overall sentiment remains positive for AI’s potential in health care, provider organizations’ expectations have shifted since 2018. These organizations are increasingly viewing AI as a tool that will provide incremental value, as opposed to being a transformative, essential part of the health system.

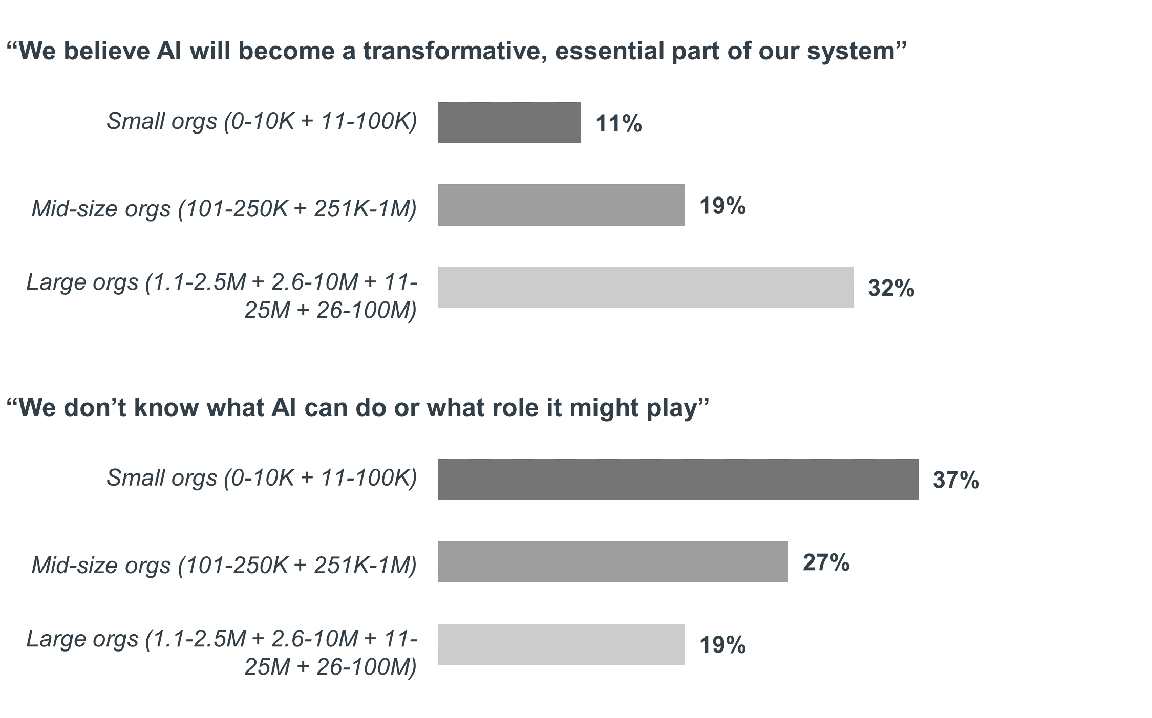

Breaking this out across organization size, we see that the belief in incremental value holds strong across small, mid-sized and larger organizations. However, small and mid-sized organizations are less certain of the role or value that AI can have for organizational objectives, while large orgs are more optimistic about AI’s transformative value.

Across different types of organizations, we notice that academic medical centers (AMCs) hold AI’s transformational value as particularly high. Here, 45% of AMC respondents believe AI will become a transformative, essential part of the health system, compared to 19% of total respondents. Physician medical groups, as well as independent hospitals, expressed the most skepticism over AI’s potential value and role within their organizations (36% and 48%, respectively).

Rather than a rejection of the technology, the shift in enthusiasm among provider organizations from “transformational AI” to “incrementally valuable AI” most likely represents and increasingly nuanced understanding of the challenges around AI/ML—especially the challenges of making AI effective in the real world. Indeed, this evolution of perspective may well be a positive point for AI’s longevity and success in health care, as leaders understand the complexities of the technology better and recognize that transformative change will not result overnight.

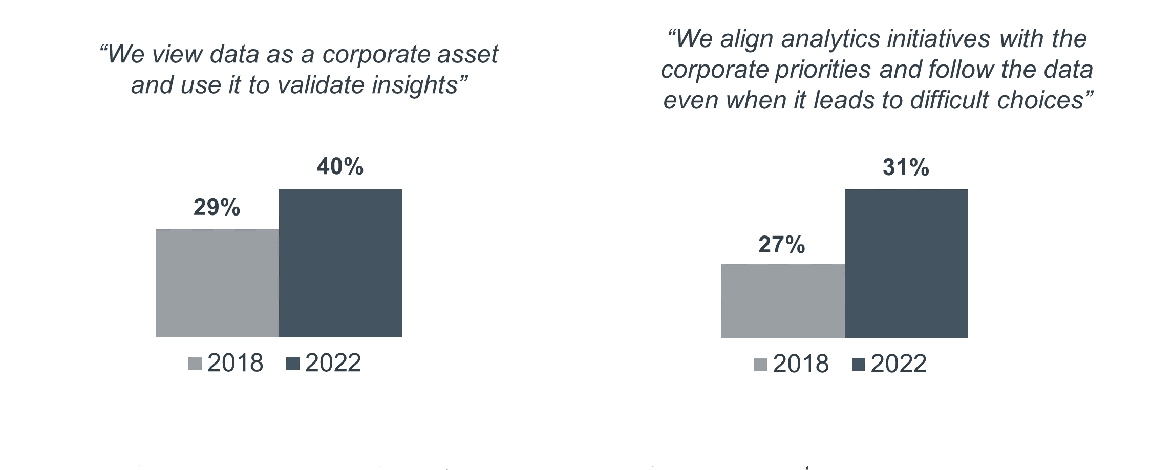

Organizations view traditional, retrospective analytics as a corporate asset and align analytics initiatives with corporate priorities to follow the data, even when it leads to difficult choices.

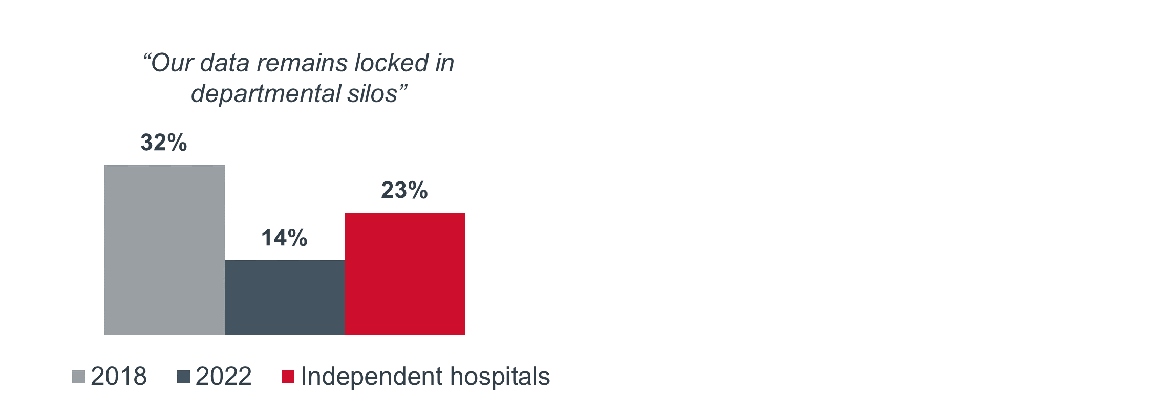

Organizations also report significant de-siloing of data since 2018, but independent hospitals still lag behind in this area.

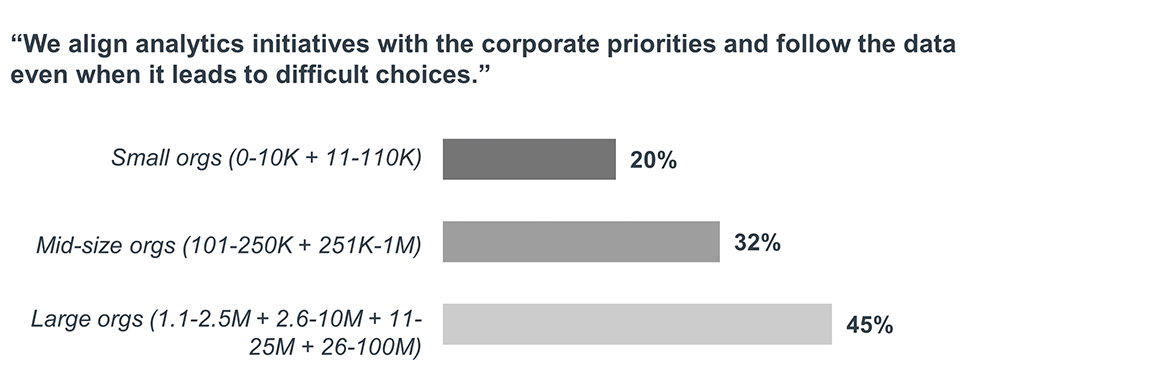

Larger organizations show greater alignment between their analytics initiatives and corporate priorities. This could be explained as, the larger the organization, the more critical it is for strategic priorities to be guided by numbers rather than project champions—Something that is important always, but has less leeway the larger an organization becomes.

Yet, even with this change, the most “progressive” organizations in this space have shifted since 2018. Here, just 7% of organizations say they truly “celebrate analytics as a corporate asset and that is reflected in its funding and staffing.” Unchanged from four years ago, this point again highlights the incremental narrative we see across this data. More and more organizations are recognizing the importance of analytics as part of the ecosystem infrastructure, but there is a lag in fully reflecting that recognition in funding and human capital.

Analytics has grown in presence in the C-suite. However, who leads the charge for an organization sets the tone for how analytics are perceived and prioritized.

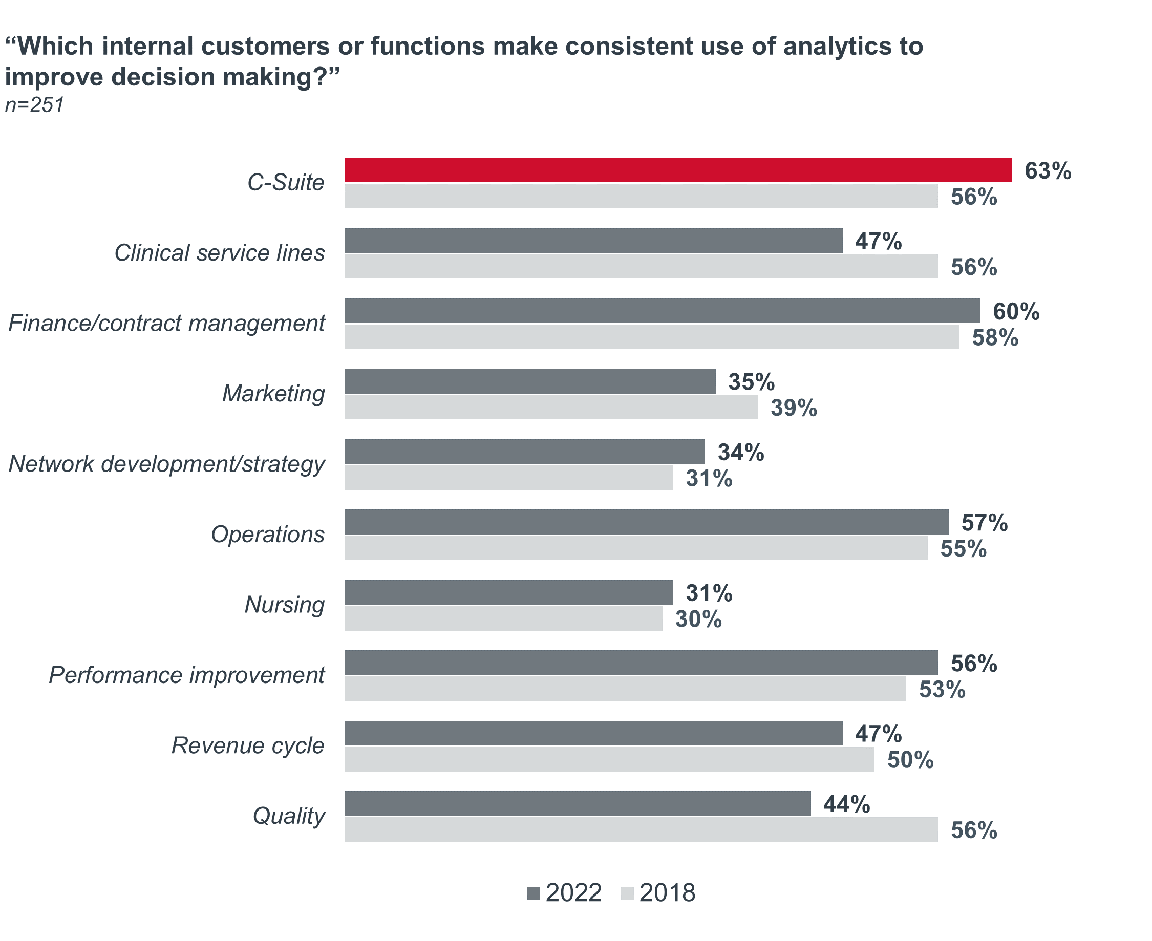

The C-suite saw the biggest increase since 2018 when asked which internal departments consistently use analytics to improve decision making. Beyond this cohort, org functions varied only slightly in use relative to 2018. Areas like operations, performance improvement, and finance/contract management saw slight increases. Others, like clinical service lines, marketing, revenue cycle, and quality decreased in their consistent analytics use.

Of particular note is the drop in clinical service lines’ use of AI and analytics. Admittedly, the past two years of the Covid-19 pandemic have pressure tested clinical operations and shifted many priorities in this space away from pushing transformation and more towards essential advancements of technology and digital health for day-to-day care.

However, there may be an alternative narrative to keep in mind. If organizations continue to look to implementing clinical AI or convincing service lines of its potential value, they must first identify if the clinical department that they’re working with is either:

- Behind on implementation – Meaning they’ve been working with AI or analytics less and are not as open to new technology, or

- More than ready for new assistive technologies – Meaning there is pent-up demand because clinical teams have been so focused on survival operations.

In addition to new levels of use, the C-suite has also grown in its analytics leadership. Over half (52%) of respondents reported a predominant stewardship by a technology- or data-related role such as a CIO, CTO, CMIO/CNIO, or Chief Data/Analytics Officer.

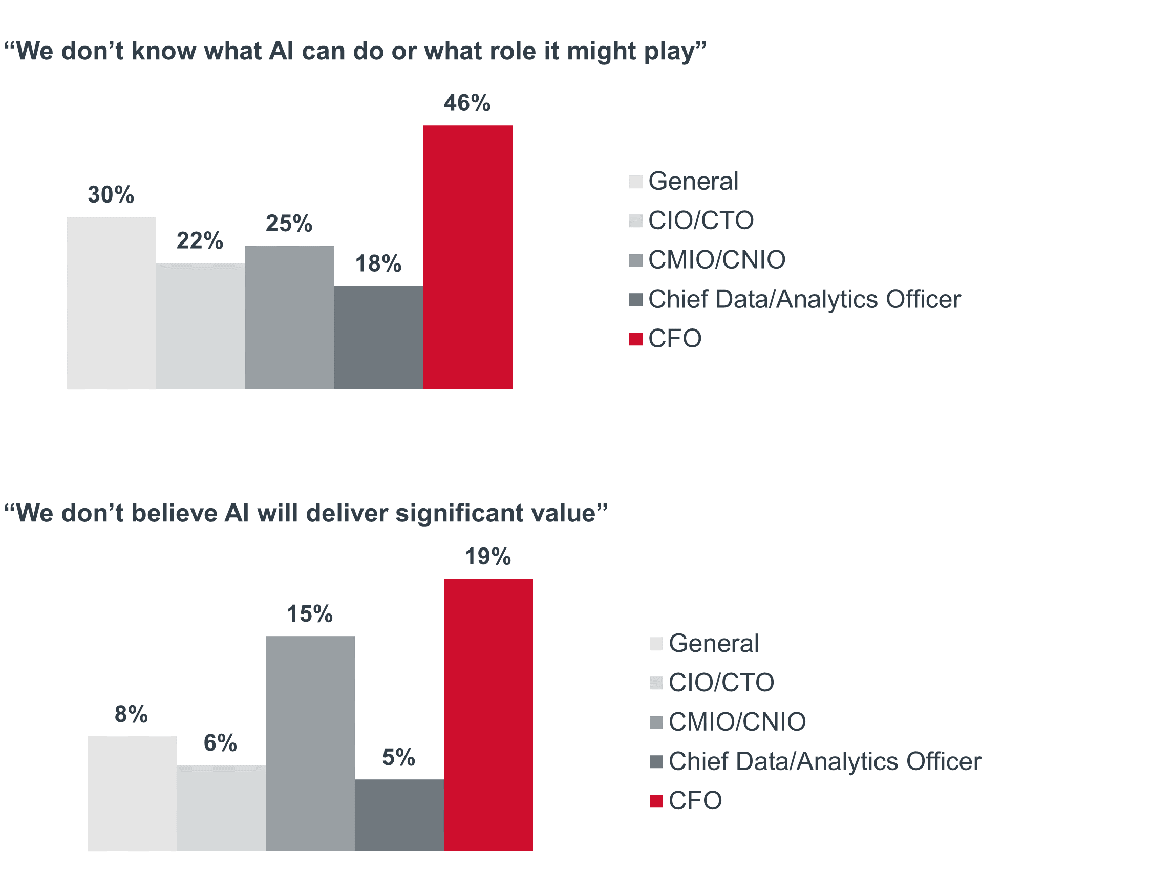

Who leads the charge for analytics across organizations sets the tone for how it is perceived and prioritized. Here, most technology- and data-related leaders favor the incremental value of AI over its transformational potential. However, Chief Data and Analytics Officers were the only group across all data segments who favored the transformative, essential value of AI over other response options.

Conversely, when analytics efforts are led by a Chief Financial Officer (CFO), there was actually a negative perception of AI’s potential value for the organization. This was the only data segment where there was a predominantly uncertain or doubtful sentiment over other response options.

As a whole, organizations are recognizing the incremental value of AI and expect a wave of increased funding by 2024.

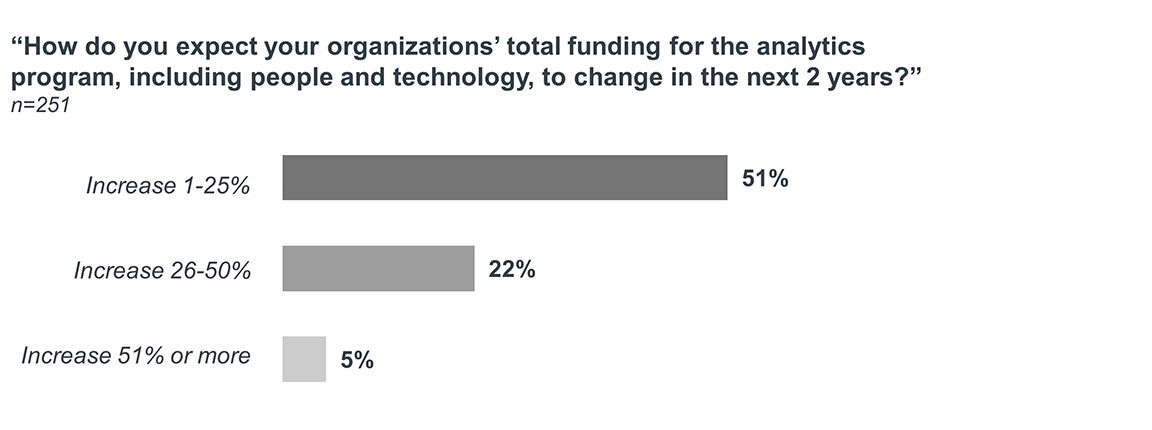

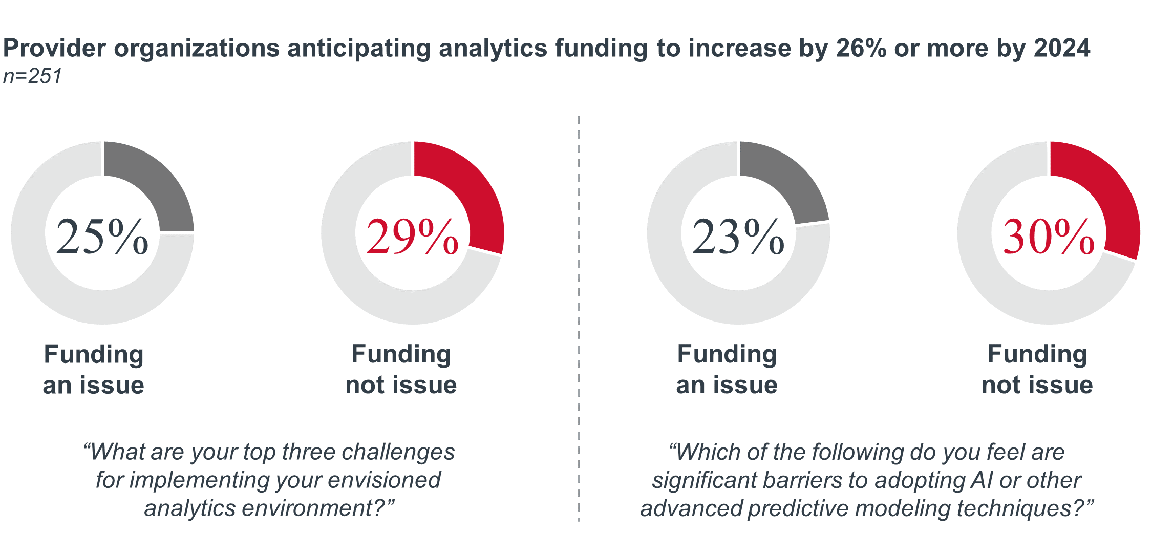

A staggering 78% of total respondents expect to see some increase in funding, while just 1% reported expected decreases. Of particular interest are the 27% of organizations who report expecting their analytics funding to increase by 26% or more in the next two years.

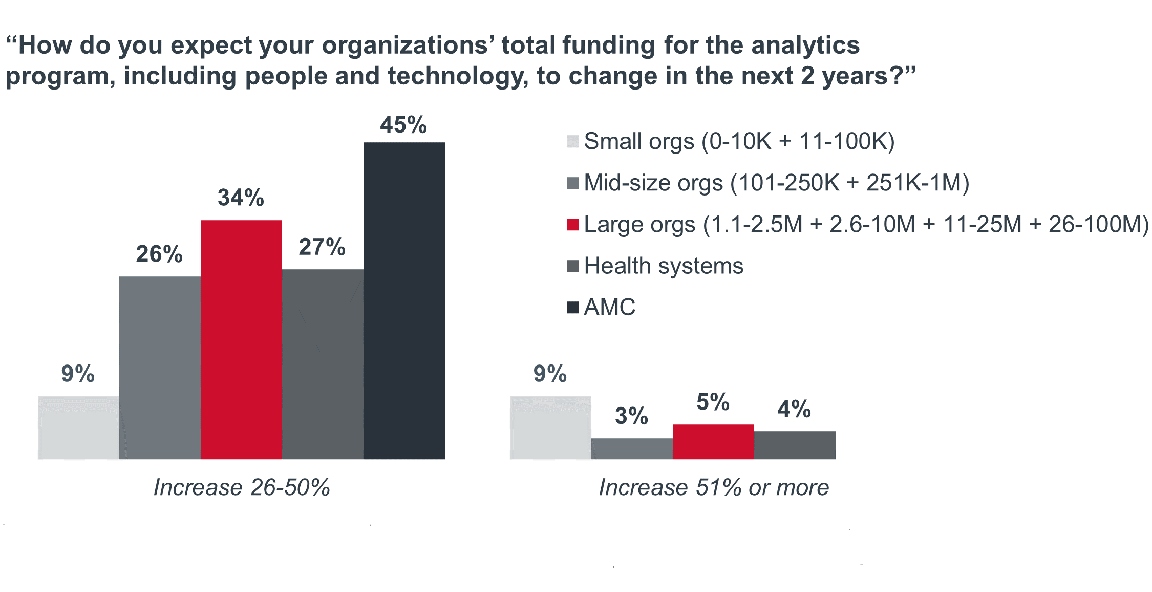

Larger organizations, as well as health systems and AMCs, tend to expect their analytics funding to increase by 26% or more.

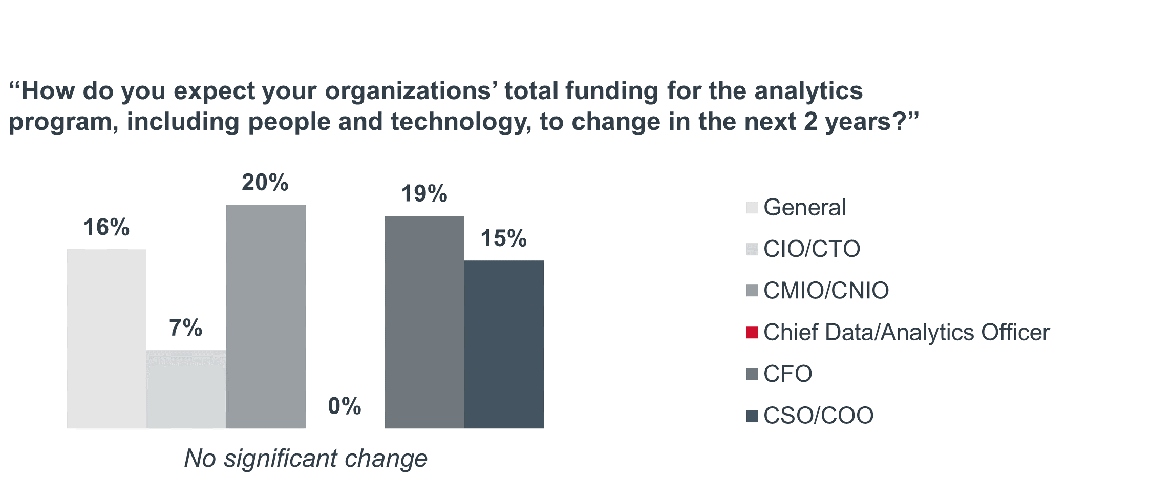

When analytics efforts are spearheaded by C-suite leaders who are not in a technology- or data-related role, there is much more stagnation in funding. Here, we see 2-3x more respondents citing “no significant change” in analytic budgets by 2024.

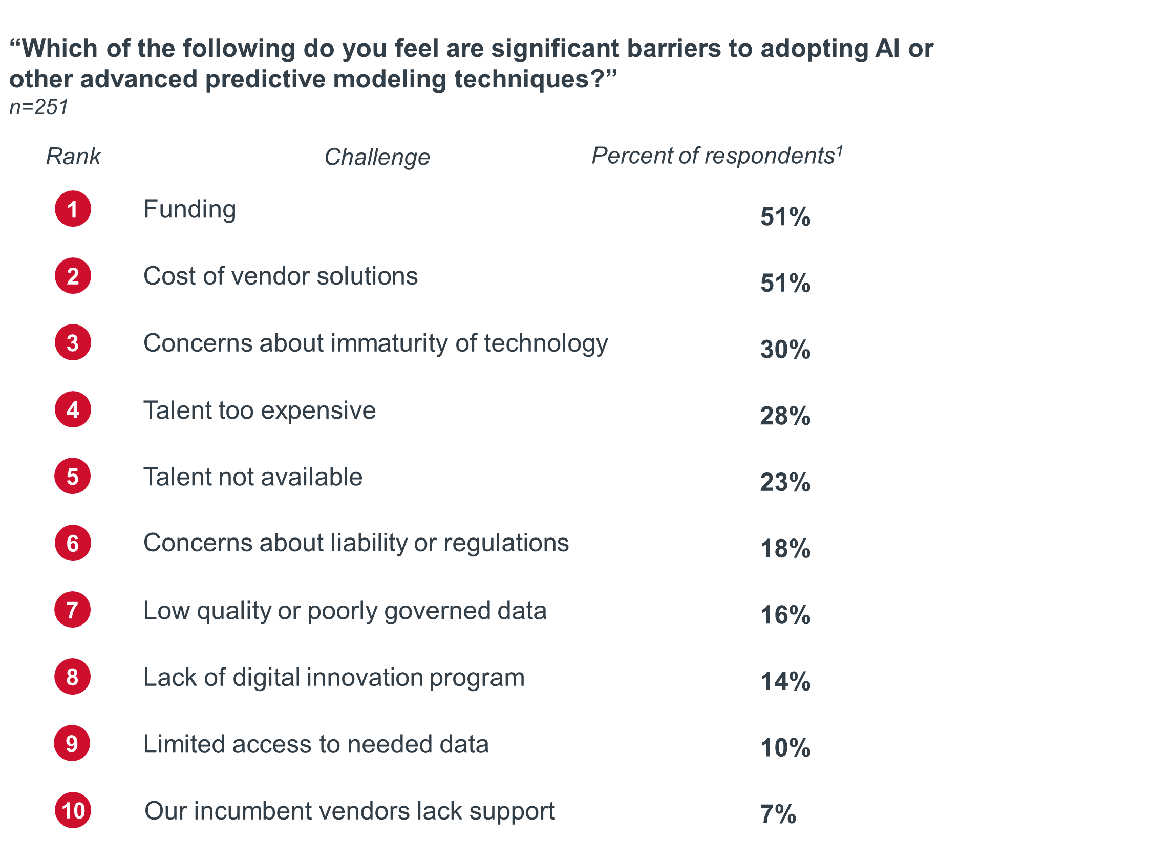

Funding and staff capability are the standout challenges for organizations in their quest to implementing their ideal analytics environment.

We asked about obstacles to full AI and analytics adoption across two questions, detailed below. Overall, organizations find funding and staff to be their biggest challenges. Beyond this, they also feel pressure from existing projects and non-analytics priorities that impede full implementation.

Organizations who reported “Funding” as a challenge in either question above showed a similar split to their anticipated analytics funding by 2024 (detailed on pg. 13 of the PDF). However, those who did not report funding as an issue expect to their analytics funding increase by 26% or more over the next two years.

Across this trove of data, one question stands out: where do we go from here?

Realistic expectations and shifts in considering AI’s potential value in health care represent not wary pessimism, but rather a genuine maturity in providers’ understanding and use of AI/analytics. The structural, systemic, and cultural changes required to take full advantage of AI in health care are real and must be addressed proactively and incorporated into investment decisions.

That does not mean health care should abandon transformative aspirations. AI can have an outsized, positive impact on health care. The challenges of total cost of care, administrative burden, clinician burnout, and patient experience have not responded to the non-AI solutions in health care’s toolkit. Health care may worry about the cost of analytics solutions, but the cost of not trying new tools like AI may be even greater.

The prevailing challenge of AI and analytics in health care is one of balance and tradeoffs, like how to capture the potential of an application in the as-is reality of clinical workflows. Health care organizations need to balance AI use cases that provide incremental value today with those that will be transformational in the future. Indeed, it will likely be through such incremental adoption that we see AI’s full transformational force in the future.

At Optum, we are a leading health services innovation company dedicated to helping make the health system work better for everyone. We create simple, effective and comprehensive solutions for organizations and consumers across the whole health system by integrating our foundational competencies of consumer experience, clinical expertise, data and analytics, and embedded technology into all Optum services. By understanding the needs of our customers, members and patients and putting them at the center of everything we do, we will achieve our aspiration of improving experiences and outcomes for everyone we serve while reducing the total cost of care.

This report is sponsored by Optum®, an Advisory Board member organization. Representatives of Optum helped select the topics and issues addressed. Advisory Board experts wrote the report, maintained final editorial approval, and conducted the underlying research independently and objectively. Advisory Board does not endorse any company, organization, product or brand mentioned herein.

This report is sponsored by Optum®. Advisory Board experts wrote the report, maintained final editorial approval, and conducted the underlying research independently and objectively.

Learn moreDon't miss out on the latest Advisory Board insights

Create your free account to access 1 resource, including the latest research and webinars.

Want access without creating an account?

You have 1 free members-only resource remaining this month.

1 free members-only resources remaining

1 free members-only resources remaining

You've reached your limit of free insights

Become a member to access all of Advisory Board's resources, events, and experts

Never miss out on the latest innovative health care content tailored to you.

Benefits include:

You've reached your limit of free insights

Become a member to access all of Advisory Board's resources, events, and experts

Never miss out on the latest innovative health care content tailored to you.

Benefits include:

This content is available through your Curated Research partnership with Advisory Board. Click on ‘view this resource’ to read the full piece

Email ask@advisory.com to learn more

Click on ‘Become a Member’ to learn about the benefits of a Full-Access partnership with Advisory Board

Never miss out on the latest innovative health care content tailored to you.

Benefits Include:

This is for members only. Learn more.

Click on ‘Become a Member’ to learn about the benefits of a Full-Access partnership with Advisory Board

Never miss out on the latest innovative health care content tailored to you.