Auto logout in seconds.

Continue LogoutThe health care industry is struggling to move on value-based care, and many wonder what the future will look like. But while progress is slow, Medicare is moving toward risk. Commercial risk is the wild card. Because of this, the future of commercial risk will decide if the industry lives in a hybrid state forever or realigns around a new cost and quality standard.

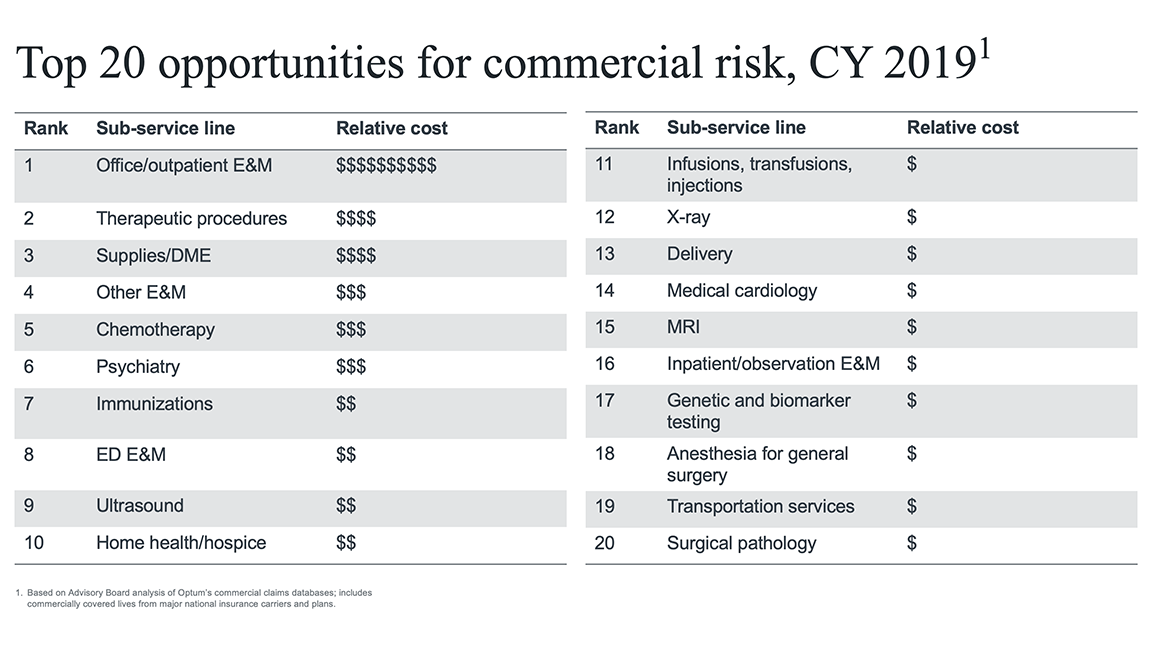

After examining the barriers and possibilities in commercial risk qualitatively, we dug into the top opportunities in claims data. Below is our initial analysis.

Our team analyzed a robust database of commercial claims with nationwide coverage.

Within the data set, we focused on professional (non-facility) claims to identify the outpatient and ambulatory sub-service lines with the highest spending for commercial patients under age 65 in CY 2019.

Our team identified the primary procedure or service performed on each claim and attributed that claim to the corresponding sub-service line. We used average, price-normalized commercial rates reported at the claim level as a proxy for cost and spending.

- Chronic conditions: For all the focus on chronic care management in Medicare ACOs, we see it less in the commercial data set. (Medical cardiology comes in at number 14, which is the highest ranking for a sub-service line focused on chronic care management.) Commercial patient management places greater emphasis on prevention with some early screening and far less emphasis on chronic care management.

- Surgeries: Because our data set captured professional rather than facility claims, surgeries are missing. We know employers are already focused here, with Walmart and other employers establishing centers of excellence to prevent unnecessary surgeries. Further analysis from our team will help us compare this opportunity to the rest of the list.

- Prescriptions: Same story with prescriptions. Prescriptions are another common starting point for employer focus, given that pharmaceutical spending accounts for around 14% of total health care expenditures. Most common prescriptions are excluded from this data set.

- ED E&M (#8): Two-thirds of annual hospital ED visits by privately insured patients – 18 out of 27 million – are avoidable. The cost of ED E&M can be driven down by trading ED visits for urgent care and catching patients before they escalate to the ED.

- Delivery (#13): We’d expect delivery to be even higher on this list if facility claims were included in our data set. And these high costs are accompanied by high volumes, as childbirth is the leading reason for hospitalization of women in the United States. We’re looking at the entire pregnancy care pathway and areas to improve outcomes and decrease the cost burden of delivery, such as prenatal screening and remote patient monitoring.

- MRIs (#15): MRIs—and most imaging services—are overutilized nationwide. Organizations should focus on appropriate use initiatives to reduce unnecessary imaging and drive down spend.

- Chemotherapy (#5): Chemotherapy is high on the list. We are digging into the top opportunities for partnership here including shifting sites of care, standardizing care pathways, and the use of centers of excellence or network management to direct care to high-quality, low-cost providers.

- Office/OP E&M (#1): Office/OP E&M is the highest cost sub-service line for commercial patients. And we’d expect spending in this category to increase if the patient population is well-managed (e.g., more preventive care via primary care).

- Immunizations (#7): Adherence to immunization guidelines drops after childhood. Under a well-managed population, utilization (and subsequently, cost) of immunizations would increase.

- Genetic and biomarker testing (#17): Genetic testing is an emerging area with the potential to improve medication management and treatment efficacy. However, more data likely needs to be collected before testing can become a common practice. If adopted effectively, we’d expect costs here to increase over time.

There’s another important consideration for determining which opportunities are worth pursuing: the time horizon for savings.

Due to employee turnover and employers switching health plans, the window for reducing costs in commercial is shorter than Medicare. We’re still investigating this, but early analysis indicates that the biggest opportunities for cost savings are in episodes of care that can be completed before commercial patients switch health plans.

Commercial risk is the key to industry-wide value-based care, but it’s still an open question. As we dig deeper into this data set, we’re focused on opportunities to inflect cost and improve value. Do you have thoughts on this subject? Reach out to us at hurrs@advisory.com.

More commercial claims analysis:

Don't miss out on the latest Advisory Board insights

Create your free account to access 1 resource, including the latest research and webinars.

Want access without creating an account?

You have 1 free members-only resource remaining this month.

1 free members-only resources remaining

1 free members-only resources remaining

You've reached your limit of free insights

Become a member to access all of Advisory Board's resources, events, and experts

Never miss out on the latest innovative health care content tailored to you.

Benefits include:

You've reached your limit of free insights

Become a member to access all of Advisory Board's resources, events, and experts

Never miss out on the latest innovative health care content tailored to you.

Benefits include:

This content is available through your Curated Research partnership with Advisory Board. Click on ‘view this resource’ to read the full piece

Email ask@advisory.com to learn more

Click on ‘Become a Member’ to learn about the benefits of a Full-Access partnership with Advisory Board

Never miss out on the latest innovative health care content tailored to you.

Benefits Include:

This is for members only. Learn more.

Click on ‘Become a Member’ to learn about the benefits of a Full-Access partnership with Advisory Board

Never miss out on the latest innovative health care content tailored to you.