Auto logout in seconds.

Continue LogoutOverview

The past few years have been hard for health system strategic planners, and it's not getting any easier. To find out the top challenges and priorities for the coming year, we surveyed 57 leaders at member organizations. Read on to learn the six key findings from our research.

Methodology, respondents, and research questions

Methodology and respondents

Advisory Board administered a survey on health system strategy from April 26 to May 12, 2022. The survey included Likert scale questions, ranking exercises, and true/false questions. Analysis of the results included follow-up interviews with a portion of the survey respondents.

There were 57 total respondents. Common role descriptions of the respondents were: chief strategy officers, chief executive officers, and VPs and directors of strategy, planning, and/or business development. Respondents work predominately at health systems and integrated delivery networks.

Research questions

With this survey, we sought the answers to six key questions:

1. How do health system margins, volumes, capital spending, and FTEs compare to pre-pandemic baselines?

2. Which volume categories are under- and over-performing in mid-2022?

3. Which disruptors are shaping provider competition and health system strategic planning?

4. What growth strategies are hospitals and health systems employing?

5. Will capital spending priorities change next year?

6. Will strategic planning priorities change next year?

Our research offers six primary findings on health system performance in 2022 and expected strategies and priorities for 2023 and beyond, detailed below.

What did we find?

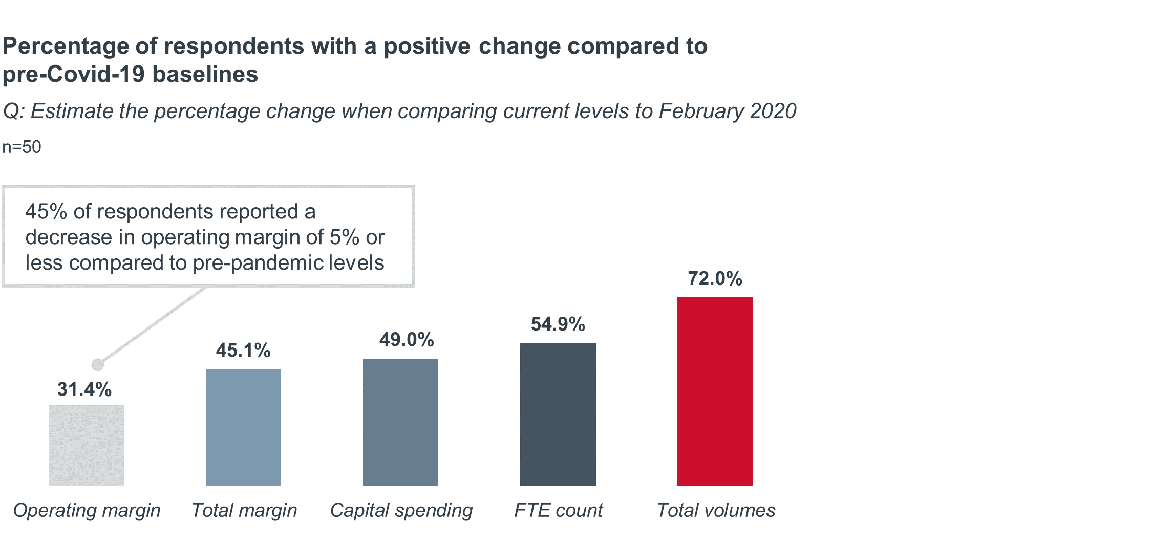

Less than one-third of our survey respondents exceeded pre-pandemic operating margin performance as of mid-2022. Results were similar across different organization types and sizes.

Though our respondents paint a bleak financial picture, there is room for optimism. Only 24% of respondents indicate a decline in operating margin of 6% or more.

Most respondents (72%) say total volumes have grown since February 2020. Though return of demand has not shielded this cohort from margin pressures. Heightened expenses and prolonged lengths of stay continue to put a drag on health system finances.

Why does this matter?

Having a prolonged period where expense growth outpaces revenue growth puts hospitals and health systems in a difficult position. Unlike many other health care industry sectors, providers are limited in their ability to implement revenue-enhancing tactics (especially price increases) to compensate for inflationary pressures.

On the expense side, up to 50% of a typical hospital’s operating costs can be attributed to salaried or contracted personnel. This is hardly an expense item health systems can afford to cut—especially for those that need to rebuild capacity. Nearly every respondent (96%) who recovered FTE count compared to February 2020 also recovered volume.

Questions to consider

1. To what extent will utilization spike in Q4 of 2022 and Q1 of 2023 due to seasonal trends and other factors?

2. Will workforce shortages continue to limit volume growth next year?

3. With risks of a recession looming large, how will income from market investments (rather than operations) contribute to or further deteriorate margin performance? How might insurance coverage and mix change for businesses impacted by an economic downturn?

4. If health systems cannot effectively contain expense growth, how will health system bond ratings and ability to access capital change? To what extent will health systems need to tap their cash reserves?

5. Will federal, state, or local regulators intervene to provide financial relief for the hospital sector?

What did we find?

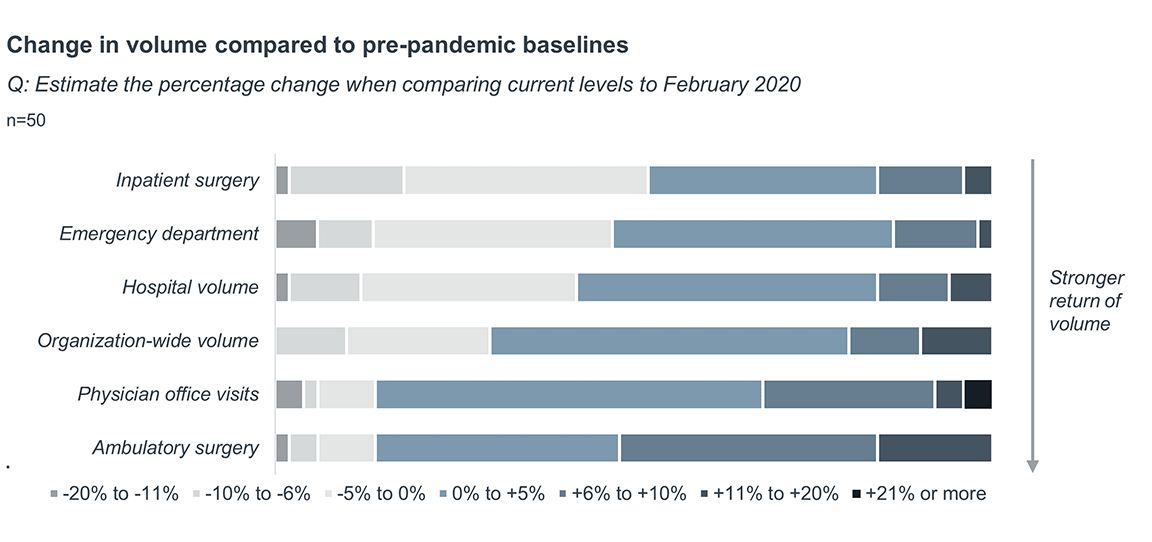

Health systems report sluggish return of inpatient surgeries simultaneously with robust growth of ambulatory surgeries. Over half (52%) report a growth in ambulatory surgery volume of 6% or more compared to just 18% indicating the same for inpatient surgery.

In addition to disproportionate growth in ambulatory volume, all but six respondents report active migration of care to non-hospital settings such as ambulatory surgery centers (ASC). These results lend credence to speculation of accelerated and permanent site-of-care shifts from recent policy, regulatory, and payment changes for non-hospital sites of care.

Why does this matter?

Sluggish growth of inpatient and emergency care volume creates a longer glide path to financial stability—especially for those without enough hospital-outpatient and ambulatory capacity.

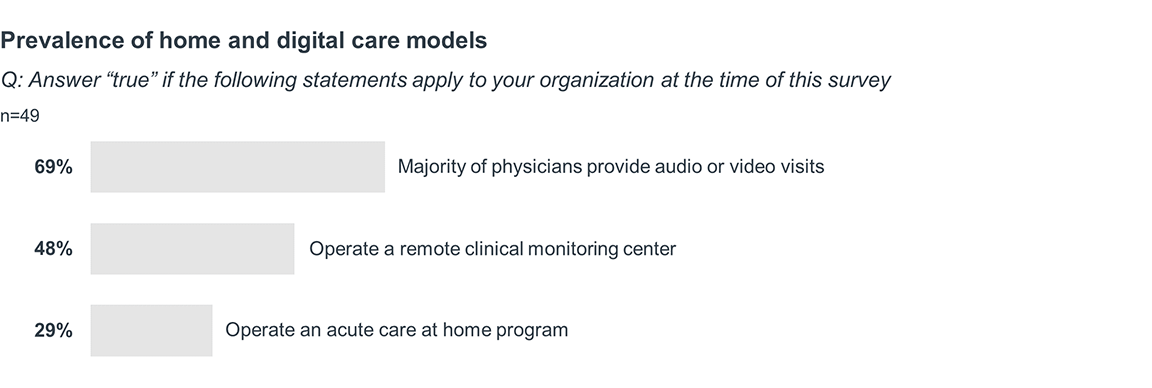

In the long term, U.S. health care policymakers and private insurers continue to support site-of-care shifts by expanding payment and influencing patient choice for alternate venues of care. Disruptive players are putting their thumb on the scale, using advantages in cost structures and capital availability to grow market share. But respondents to our survey are not resting on their laurels—a sizeable portion of respondents indicate their organizations have embraced telehealth, remote monitoring, and acute care at home models of care.

Questions to consider

1. Will federal and state lawmakers preserve payment and regulatory flexibilities initiated during the Covid-19 public health emergency for non-hospital settings of care?

2. At what pace will procedures with recent Medicare ASC payment approval—including total knee arthroplasty, total hip arthroplasty, and some cardiac catheterization procedures—shift to freestanding settings?

3. What tactics will employers and health plans use to accelerate site-of-care shifts locally?

4. To what extent will physicians partner with health systems to provide patients with community-based care options?

What did we find?

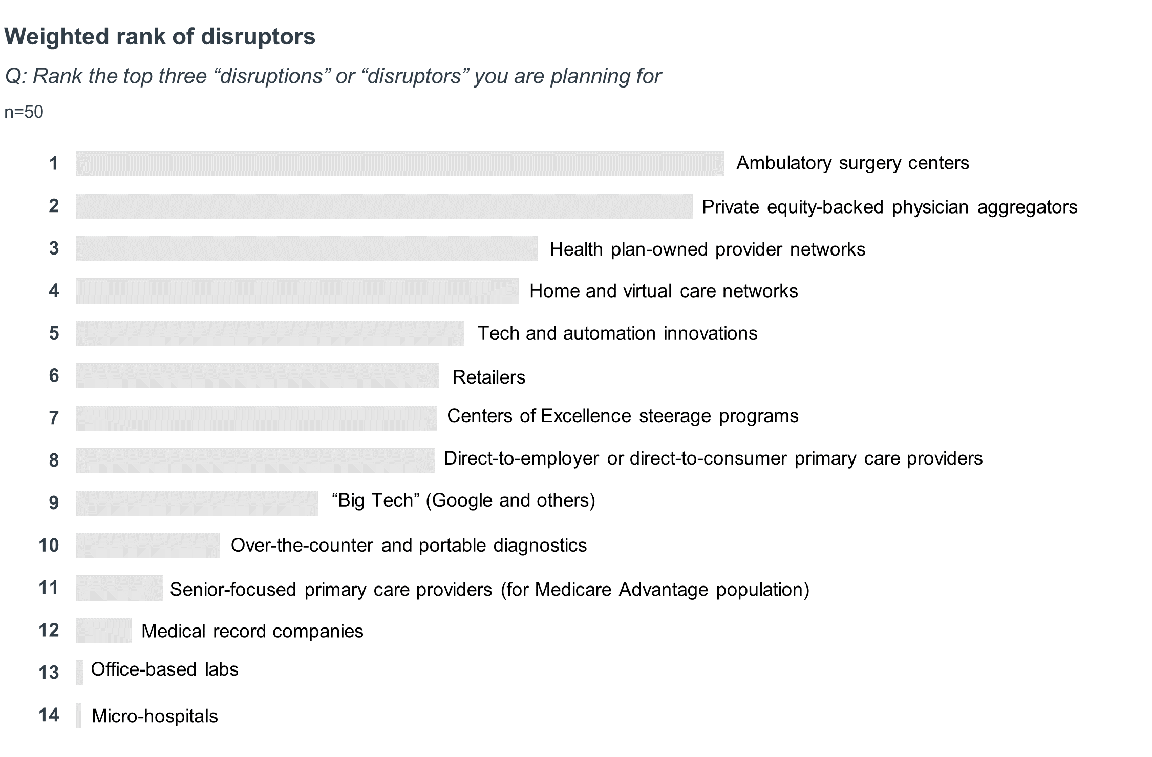

Strategists are planning for many different business risks, but the most disruptive players are direct competitors for surgical care and the physician network.

ASC operators were the most common disruptor cited, with 24 of 50 respondents ranking it in their top three. Surprisingly, “Big Tech”, senior-focused primary care providers, and micro-acute care hospitals did not rank highly. This may be because these players are seen as partners (rather than competitors), are too niche in scope, or are too isolated in current geographic presence.

Why does this matter?

Disruptive competitors are targeting profitable procedures and the referral pathways to those services. The actors (health plans, private-equity firms, retailers) are well funded and influential. Health system strategists must plan for many potential business risks, including deterioration in payer mix, heightened competition for labor, and changes in the ability to acquire and retain patients.

Questions to consider

1. To what extent will macroeconomic forces impact the amount of venture and private-equity investment in health care companies?

2. How much consolidation will occur in the digital health and physician practice sectors?

3. Can national health plans, retailers, and private-equity firms break established patient loyalties and create closed ecosystems without health systems as partners?

4. To what extent will employers be activated in narrowing networks and incentivizing use of disruptive competitors?

5. How do not-for-profit health systems cope with existential threats to their economic model while advancing their mission and ensuring equitable access to care?

What did we find?

Health system growth strategies logically tie to their beliefs on future disruption. Respondents overwhelmingly said the majority of their growth would come from two strategies: diversifying facility assets and enhancing network fidelity.

Despite expense inflation, few systems are counting on price increases. Payer and employer contracting strategies aren’t top-of-mind for this cohort either.

Why does this matter?

The combination of elevated expenses, site-of-care shifts, and new competitors makes revenue growth a critical imperative, but it is a race won in inches.

Strategists will need to leverage core competencies in physician relations and service line development to reignite growth. There will be a laser focus on business fundamentals and implementation of accretive strategies in existing markets over seeking brand new growth pastures and “big bang” acquisitions.

The lowest ranked strategies—health system M&A, contractual steerage, and price growth—may be unattainable solutions for most health systems, either because the strategies would dilute the balance sheet, divert limited resources, or be time-limited in opportunity. Indeed, only a select few health systems have been able to depend on direct-to-employer steerage contracts or “systemness” advantages as core pillars of their growth strategy to date.

Questions to consider

1. How aggressively will health systems pursue investments in ASCs, endoscopy centers, imaging centers, urgent care centers, and other ambulatory assets?

2. How will physician loyalties and referral patterns change in markets with significant physician practice acquisition activity?

3. To what extent are there untapped collaboration, co-management, employment, or joint venture opportunities with physicians locally?

4. Will health system leaders exit underperforming markets in favor of a more concentrated focus?

5. To what extent will health systems be able to enter new markets and tap into nontraditional revenue sources?

What did we find?

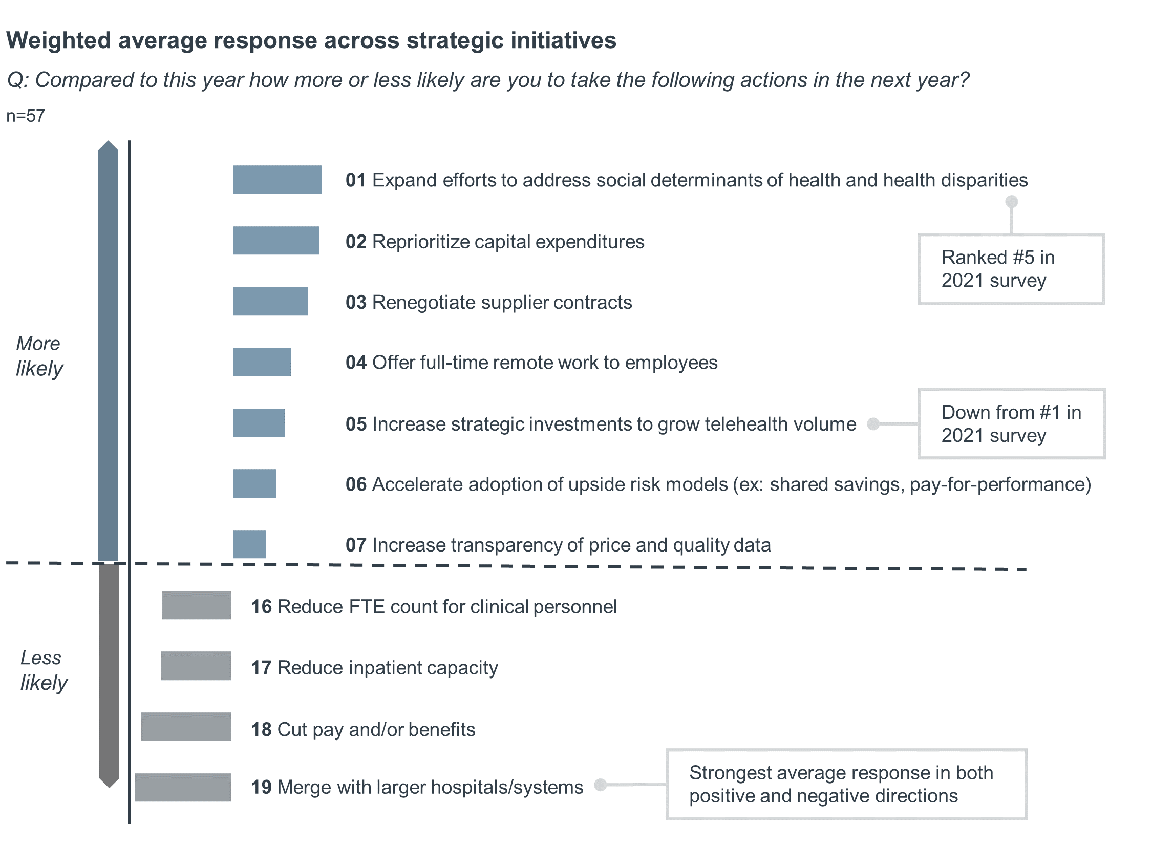

In 2023, health systems will take actions to adapt to financial pressures, avoid workforce attrition, and reinforce organization-wide commitment to community health and disparities. Overall, strategists are keeping long-term vision in mind and minimizing overly risky actions that would impact near-term sustainability.

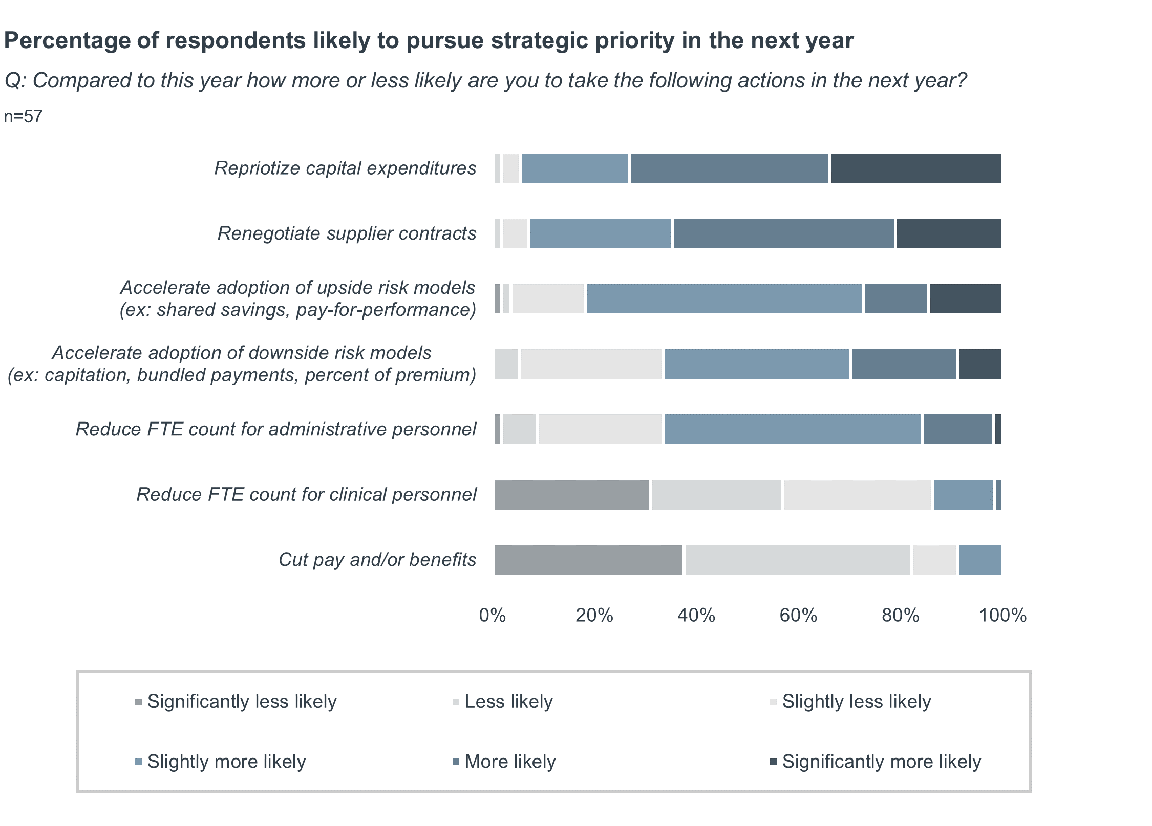

Nearly all respondents say they prefer to reprioritize capital expenditures and renegotiate supplier contracts to alleviate margin pressures. These actions are much more desirable compared to workforce cuts. Just 14% of respondents said they would reduce FTE count for clinical personnel in 2023. Even fewer (9%) said they would cut pay and/or benefits.

Our respondents are not naive to the outsized influence of labor costs on financial performance though. Any workforce cut is undesirable, but two-thirds of respondents indicate they are likely to reduce FTE count for administrative personnel in 2023.

Our respondents don’t have strong feelings about accelerating transition to risk-based payment models. Most say they will accelerate transition to both upside and downside models next year, but average strength of response indicates minimal momentum for change.

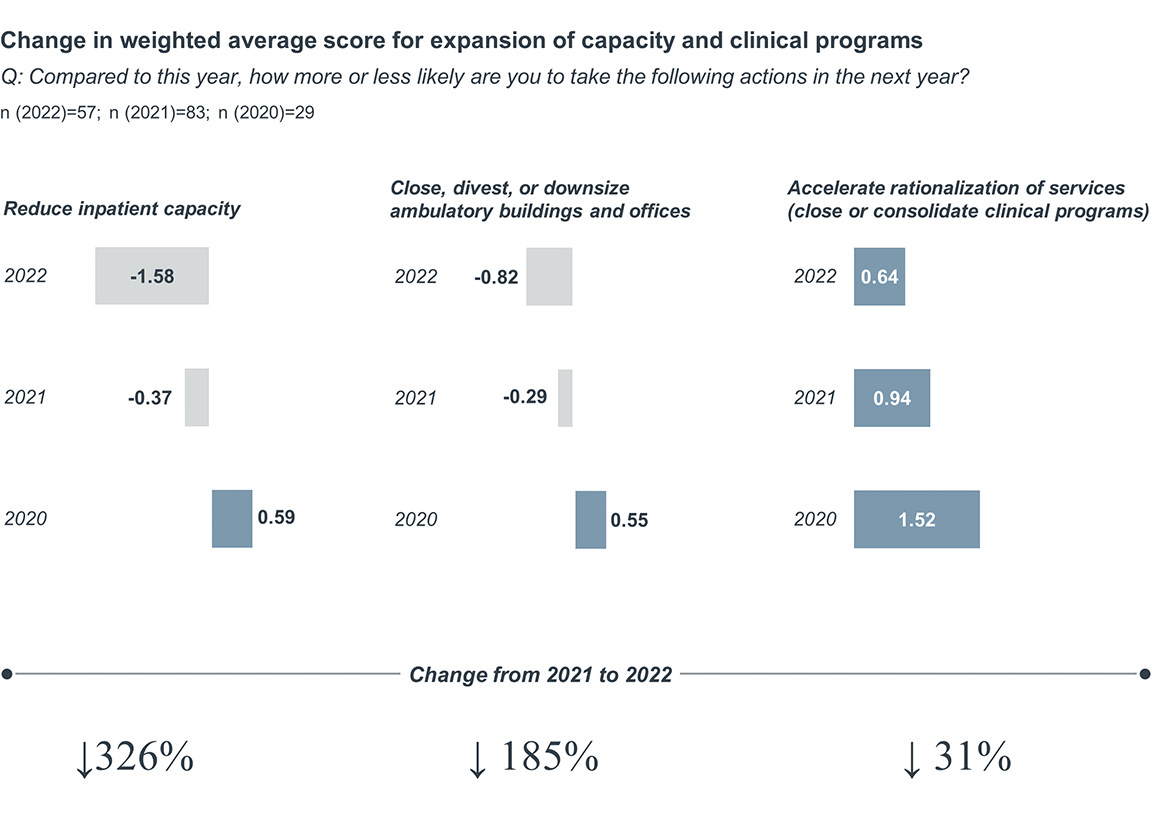

The starkest change from our 2021 survey was observed with likelihood to reduce inpatient capacity, which decreased in average response score by 326%. A similar, but less pronounced decline was seen with likelihood to close, divest, or downsize ambulatory buildings and offices (185% decrease). In light of most health systems’ desire to maximize capacity and revenue, we expect continued reluctance to cut services and capacity into 2023.

In contrast to wholesale reductions in facility capacity, our respondents will continue to reevaluate access and distribution of individual clinical programs. There were modest declines in likelihood to accelerate rationalization of services since 2021 (31% decline), but average likelihood to consider this action remains positive for 2023.

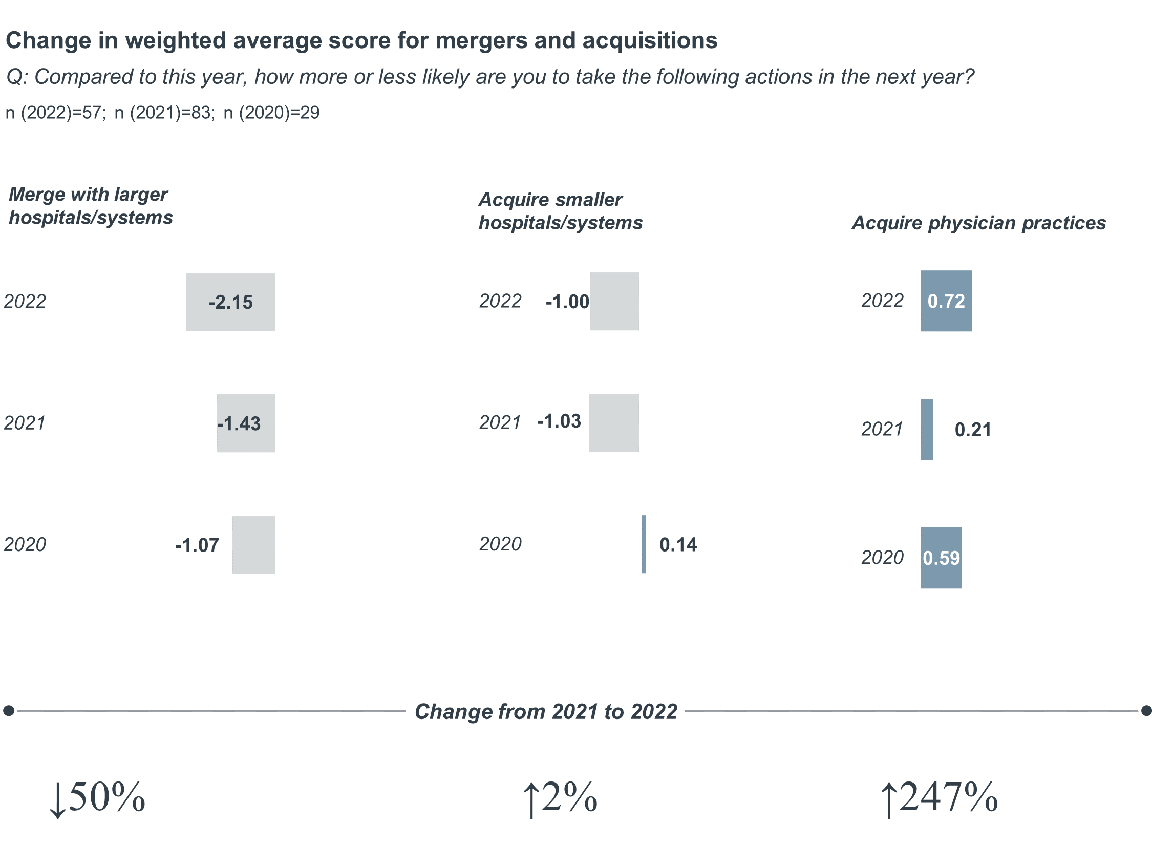

Our respondents indicated strong aversion to mergers with larger hospitals and health systems— only four respondents indicated they were likely to pursue this action in 2023. Notably, our survey indicated low likelihood to pursue mergers and acquisitions in our 2021 survey as well. These results coincided with uncharacteristically low deal activity across 2022. It is possible low deal activity will continue in 2023 as organizations preserve cash reserves, adapt to rising interest rates, and get their own house in order financially and strategically.

The same aversion was not observed when asked about likelihood to acquire physician practices. While this was only eighth in terms of overall strategic priority, 70% of respondents said they are more likely to acquire physician practices in 2023. Health systems recognize that creating relationships with physicians is extremely important in an environment where care is shifting outpatient. But with more acquirers than ever, health systems have their work cut out to demonstrate they are an ideal partner for those seeking acquisition.

Why does this matter?

Health systems are balancing long-term strategic priorities with present financial realities. Strategists are clearly optimistic in their ability to achieve stable financial and strategic footing in 2023.

Our 2022 survey results may throw cold water on those predicting mass closure or consolidation in the health system sector. Notwithstanding the survey results, health systems face significant business risks in 2023 that can’t be understated. Leaders will need to continue to navigate disruptive market forces, energize their workforce around mission-driven priorities, and capture volumes at risk of shifting to non-hospital settings to support health needs of the community into the future.

Questions to consider

1. Will targeted cost-cutting actions be enough to stabilize margins? To what extent will health systems turn to more drastic actions impacting access to care and the clinical workforce?

2. How will cuts to administrative personnel impact the ability of health systems to generate future growth and preserve cultural cohesion?

3. How will health systems position themselves to be the physician employer and practice acquirer of choice?

4. Will health systems be compelled to take action on price transparency and payment reform initiatives in the next year?

5. Can strategists stay nimble amid rapid change?

What did we find?

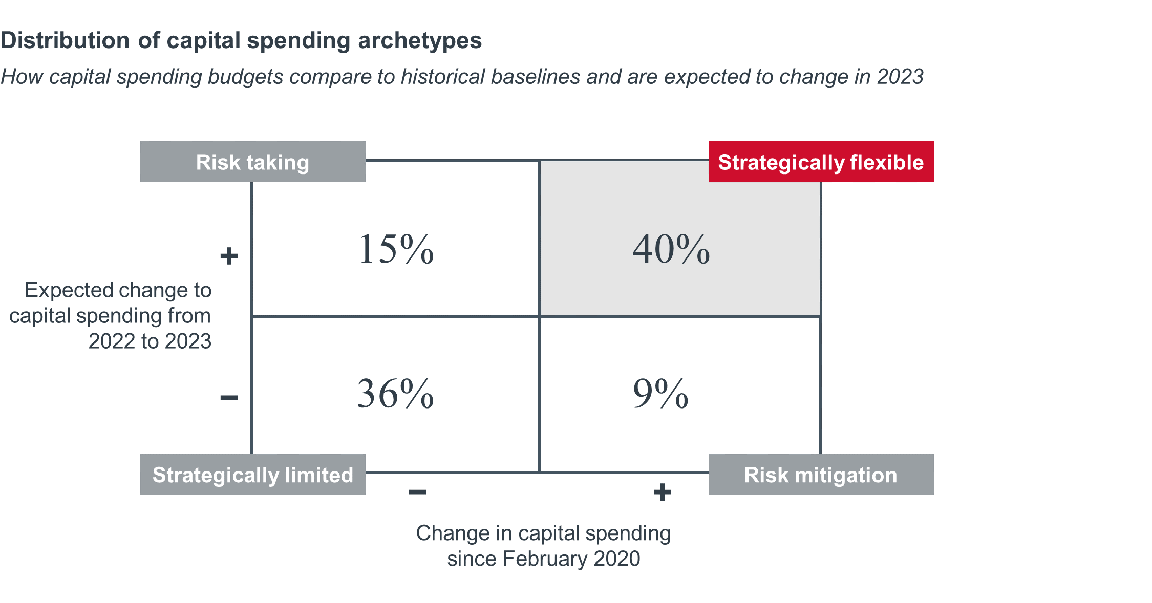

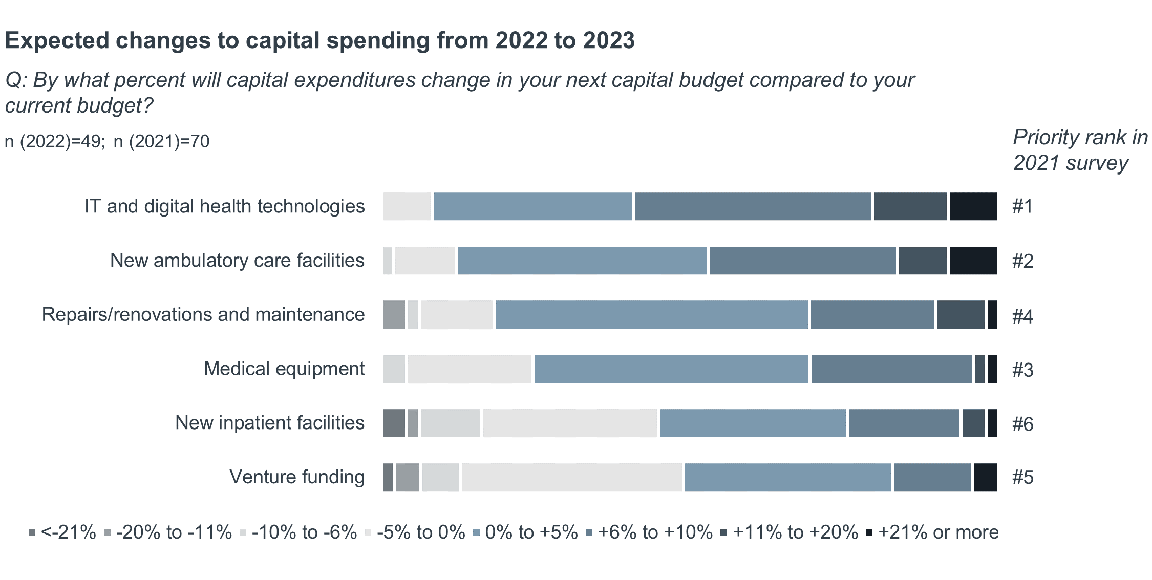

Most respondents (55%) expect to increase capital spending from 2022 to 2023. Increases will be modest. Only 10% of respondents will increase their current budgets by 6% or more.

A smaller subset of respondents (40%) are what we call “strategically flexible”—defined as those that have had a positive change in their capital spending budgets compared to early 2020 and expect a further increase in spending budgets next year.

Why does this matter?

Organizations with strong financial performance have license to pursue desired strategies, while poor performers are limited in their strategic options. Health systems will have to prioritize across many competing priorities and make bets on the investments necessary to fund the long-term strategy and vision of the organization.

Consistent with last year’s survey, respondents say they will prioritize IT and digital health technologies as their number one priority in 2023.

Questions to consider

1. Will deteriorating health system bond ratings and rising interest rates impact the ability of health systems to finance necessary investments in future strategy?

2. Given the time lag between IT spending and IT benefits realization, how committed will organizations be to IT spending over time (particularly if interest rates don’t return to levels of the previous three years)?

3. How will health systems navigate the political fallout that may come with favoring ambulatory and IT over hospital investments?

4. Will vendors introduce new flexible financing models to support continued partnership and uptake of capital-intensive products?

Don't miss out on the latest Advisory Board insights

Create your free account to access 1 resource, including the latest research and webinars.

Want access without creating an account?

You have 1 free members-only resource remaining this month.

1 free members-only resources remaining

1 free members-only resources remaining

You've reached your limit of free insights

Become a member to access all of Advisory Board's resources, events, and experts

Never miss out on the latest innovative health care content tailored to you.

Benefits include:

You've reached your limit of free insights

Become a member to access all of Advisory Board's resources, events, and experts

Never miss out on the latest innovative health care content tailored to you.

Benefits include:

This content is available through your Curated Research partnership with Advisory Board. Click on ‘view this resource’ to read the full piece

Email ask@advisory.com to learn more

Click on ‘Become a Member’ to learn about the benefits of a Full-Access partnership with Advisory Board

Never miss out on the latest innovative health care content tailored to you.

Benefits Include:

This is for members only. Learn more.

Click on ‘Become a Member’ to learn about the benefits of a Full-Access partnership with Advisory Board

Never miss out on the latest innovative health care content tailored to you.