Auto logout in seconds.

Continue LogoutFor health plans operating in the Medicare Advantage (MA) line of business, the name of the game is standing out from the crowd. This is increasingly difficult in the highly competitive MA marketplace. The average senior in 2023 has the choice of 43 different MA plans — and for seniors living in more populated areas like Dallas or Los Angeles, that number can be over 65 different plan options.

People need help understanding a complex system

Given the complexity of health insurance in the United States, seniors find it hard to adequately understand and select the best product on their own. Health plans and brokers consistently report that seniors struggle to understand the different components of Medicare Parts A, B, C, and D. Asking seniors to compare over 40 different MA plans for meaningful differences is just not feasible. That’s why most seniors aren’t making these decisions on their own — and it's where MA brokers come into play.

MA brokers sell a variety of different MA plans, often from several different carriers (e.g., UnitedHealthcare,1 Humana, Aetna, Blues plans). The job of the brokers is to help seniors select the product that’s best for their unique needs. However, based on our conversations with MA brokers, most brokers feel more like educators than salespeople. They can spend over an hour just explaining the different parts of Medicare to a senior. Additionally, while brokers do receive a commission from the health plan when a senior selects or renews their MA plan, CMS caps those commissions and they tend to be similar across most plans. With this in mind, brokers state that picking the best available plan for a given senior is in their mutual best interest. Seniors who are happy with their plans are more likely to renew and recommend the broker to friends and family.

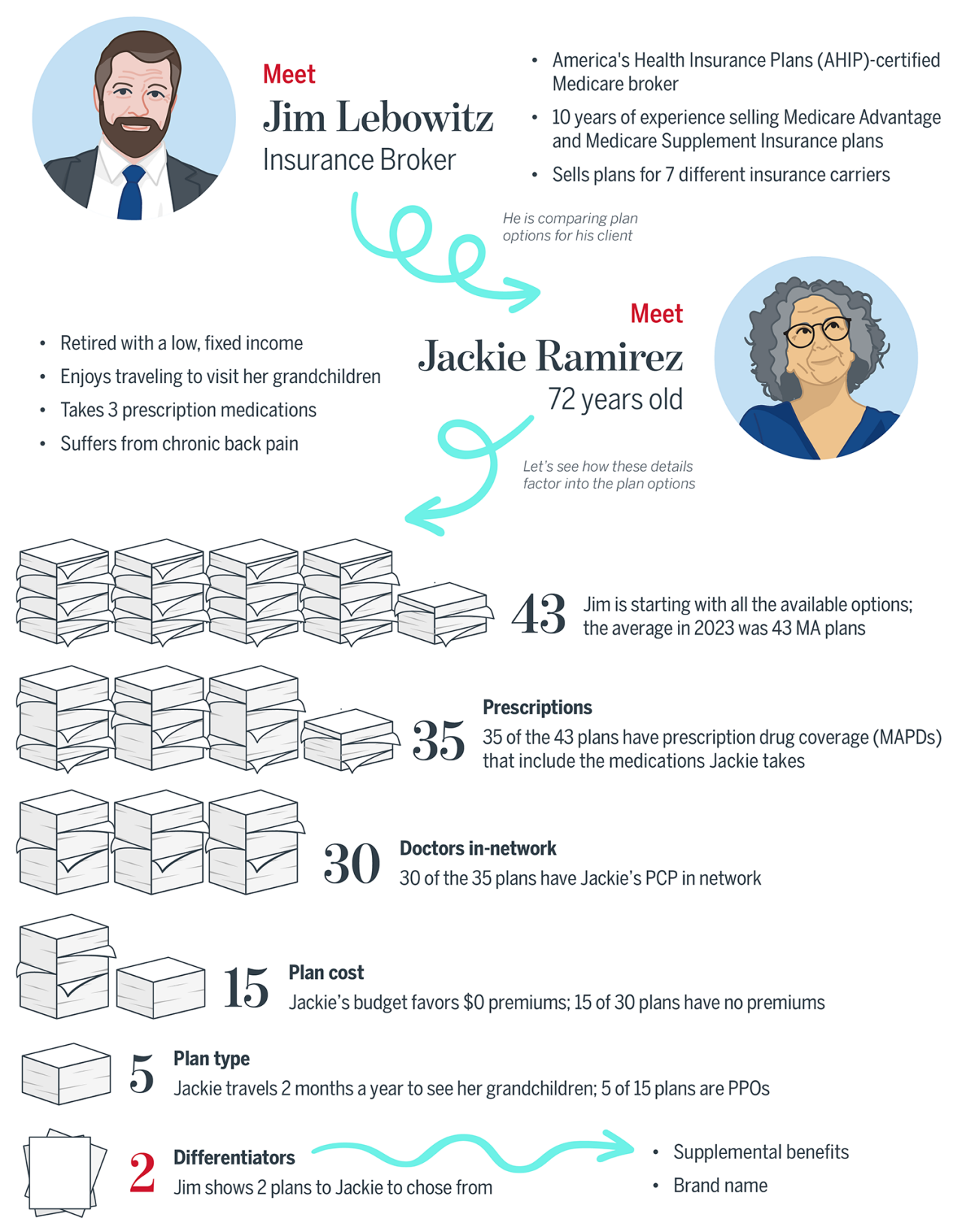

After teaching a senior about the Medicare options, brokers first need to determine if original Medicare (potentially with a Medicare Supplement Plan) or Medicare Advantage is better for that individual. There are many different factors that could determine which is the best choice for a given senior, such as the person’s income or health needs, but for this discussion we’ll focus on the considerations for seniors interested in Medicare Advantage plans. Let’s walk through an illustrative example of how an MA broker, we’ll call him Jim, can go from the 43 plans available to a senior, we’ll call her Jackie, down to recommending just a few options.

Starting point — so many choices

Of the 43 Medicare Advantage plans available for individual enrollment to the average Medicare beneficiary in 2023, 35 of the plans include prescription drug coverage (MAPDs). Since 89% of seniors take at least one prescription medication, and 54% report taking four or more prescription drugs, this is an important first step to narrow the field. And since Jackie does take a few prescription medications, she’s only interested in MAPD plans. Jim then checks if the drugs Jackie takes are covered under each of the plan’s drug formularies. Let’s say all 35 MAPDs cover the drugs Jackie needs.

Whittling down the options — network, cost, flexibility

From there, the next most important question is if Jackie’s current doctors are in-network for the plan since, unlike original Medicare, MA plans have provider networks. This is one of the most important factors for seniors selecting an MA plan, since many of them have long-term relationships with their doctors and aren’t interested in switching. This is particularly true for seniors’ primary care physicians. Jim determines that 30 of the remaining plans have Jackie’s PCP in-network.

The next factor Jim considers is cost, especially premium price. Advisory Board’s Senior Shopping Preferences Survey revealed that cost and staying with their current docs were far and away the most important factors for seniors when selecting an MA plan. And seniors tend to be a lot more concerned about the price of premiums versus potential out-of-pocket costs down the line. Jackie is retired and on a low fixed income, so having a low or no-cost option is particularly important to her. Of the remaining plans, 15 of them have $0 premiums.

After that, Jim needs to determine what type of network design makes the most sense for Jackie. She tells Jim that she has kids and grandkids in neighboring states that she likes to visit regularly. So, Jim decides that a PPO plan makes the most sense for her because they tend to have more network flexibility. Of the 15 remaining plans, five of them are PPOs.

Final differentiators

The final piece of the equation for Jim is whittling those five plans down to just the couple that he’ll recommend to Jackie. To do this, Jim will look through final differentiators like Part B premium givebacks, trusted brand names, plan Star Ratings, and — one of the most important final differentiators — supplemental benefits.

We’ve seen an explosion of supplemental benefits used by plans to try and attract seniors since CMS expanded their definition of a supplemental benefit in 2019. While some supplemental benefits like basic dental, vision, and hearing coverage are now nearly ubiquitous across all plans, there are other benefits less widely available. Jackie has been dealing with back pain for many years and is very interested in the acupuncture benefit (which was offered by about 45% of plans in 2022). Two of the remaining five plans offer an acupuncture benefit. So, from 43 initial Medicare Advantage plans, Jackie essentially picks between only two.

To learn more about how seniors select MA plans, check out 9 data-driven insights on senior preferences when selecting a Medicare Advantage plan.

1 Advisory Board is a subsidiary of UnitedHealth Group, the parent company of UnitedHealthcare. All Advisory Board research, expert perspectives, and recommendations remain independent.

Don't miss out on the latest Advisory Board insights

Create your free account to access 1 resource, including the latest research and webinars.

Want access without creating an account?

You have 1 free members-only resource remaining this month.

1 free members-only resources remaining

1 free members-only resources remaining

You've reached your limit of free insights

Become a member to access all of Advisory Board's resources, events, and experts

Never miss out on the latest innovative health care content tailored to you.

Benefits include:

You've reached your limit of free insights

Become a member to access all of Advisory Board's resources, events, and experts

Never miss out on the latest innovative health care content tailored to you.

Benefits include:

This content is available through your Curated Research partnership with Advisory Board. Click on ‘view this resource’ to read the full piece

Email ask@advisory.com to learn more

Click on ‘Become a Member’ to learn about the benefits of a Full-Access partnership with Advisory Board

Never miss out on the latest innovative health care content tailored to you.

Benefits Include:

This is for members only. Learn more.

Click on ‘Become a Member’ to learn about the benefits of a Full-Access partnership with Advisory Board

Never miss out on the latest innovative health care content tailored to you.