Auto logout in seconds.

Continue LogoutWe used claims data to investigate how procedures shift out of the hospital setting to enable better predictions of site-of-care shift. With a better sense of how procedures shift, health care leaders can make more informed investment and partnership decisions.

The main takeaway: While the pace of outpatient shift remains slow, some procedures did shift rapidly out of the hospital. This rapid shift happens when regulatory and market forces align, emphasizing that hospitals can’t take their market share for granted, and payer, physician, and life science stakeholders can all play a role in accelerating the pace of shift.

We analyzed two national claims data sets, CMS’ Physician/Supplier Procedure Summary file and Optum’s de-identified Clinformatics® Data Mart Database, to explore how 27 procedures shifted across care settings between 2014 and 2019.

Want more detail on our findings and methodology? Check out our full piece on Understanding how procedures shift out of the inpatient setting.

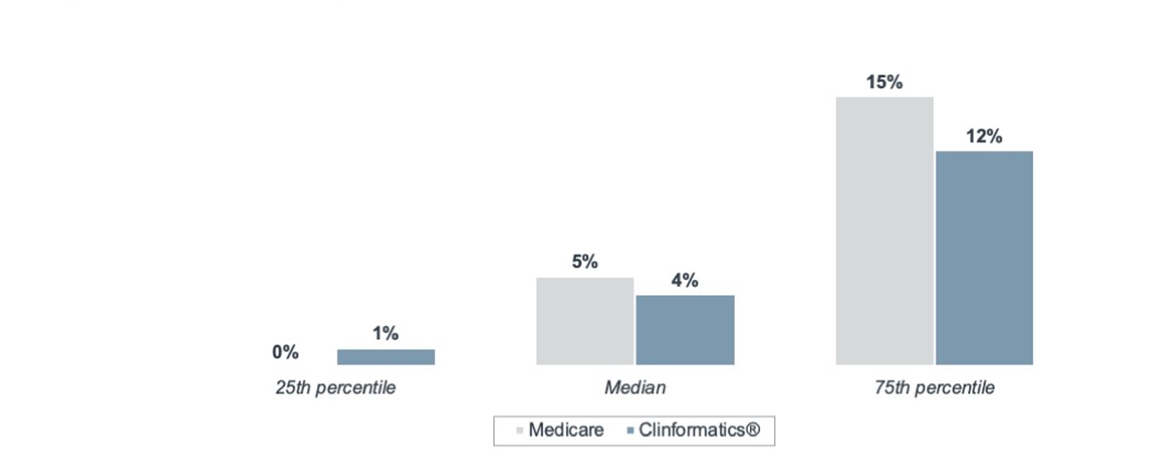

The majority of procedures analyzed only saw marginal outpatient market share growth from 2014 to 2019. Surprisingly, this outpatient shift was nearly even across both data sets, despite the differences in patient population. While the Medicare data set includes only Medicare FFS patients, who are largely over 65 years old, Optum’s de-identified Clinformatics® Data Mart Database includes patients of all ages and skews younger.

5-year outpatient market share growth across all procedures, by data set

Medicare Fee-for-Service; Optum’s de-identified Clinformatics® Data Mart Database

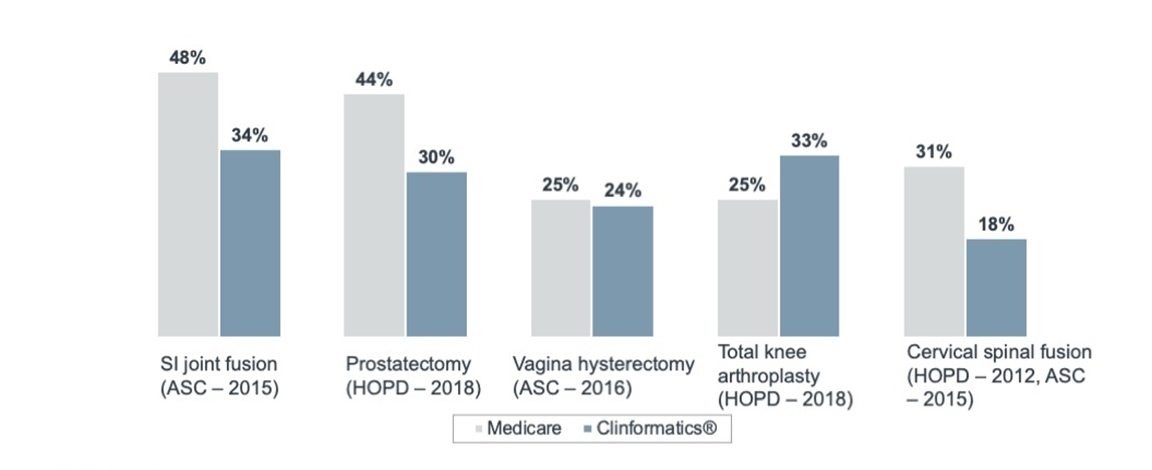

Despite this slow growth, six procedures experienced a rapid shift away from the inpatient setting, highlighted in the graph below. We found that CMS had either removed these procedures from the Inpatient Only List or added them to the ASC payable list during the analysis period. This positions regulation as a precondition for rapid outpatient market share growth.

Five-year outpatient market share growth among fastest shifting procedures, by data set

Medicare Fee-for-Service; Optum’s de-identified Clinformatics® Data Mart Database; data represents 5-year percentage point change in market share attributed to outpatient care settings

Surprisingly, both removal from the Inpatient Only List and addition to the ASC payable list increased HOPD utilization rather than increasing driving volumes in the ASC. Again, regardless of data set, median HOPD utilization grew by 12% in the four years after regulatory approval, compared to just 1% for the ASC.

Impact of ASC approval on ASC and HOPD market share, by procedure

Medicare Fee-for-Service; data represents increase in HOPD and ASC share of annual volumes in four years following ASC reimbursement approval from CMS

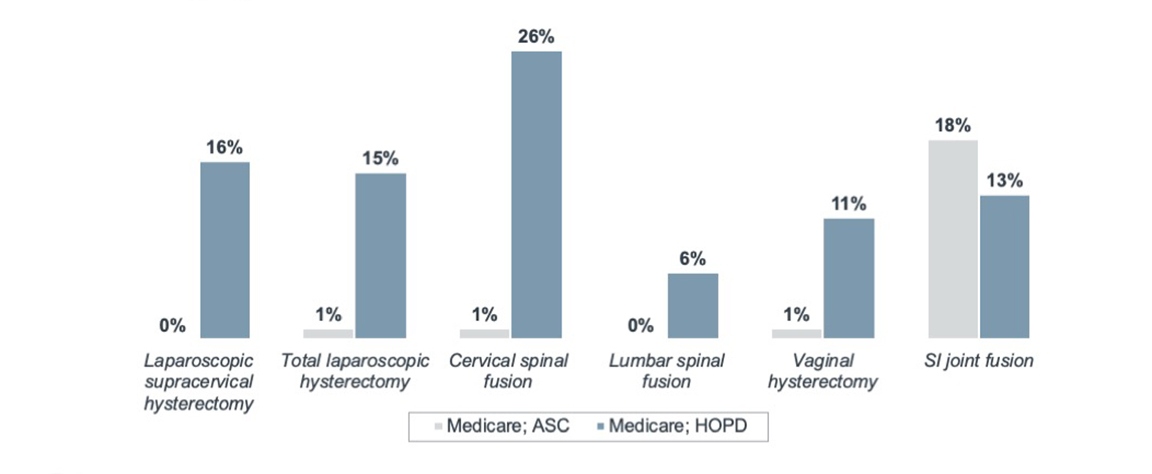

While regulation clearly plays a role in driving procedures out of the inpatient hospital, there must be other reasons behind the variation in ASC market share growth across procedures.

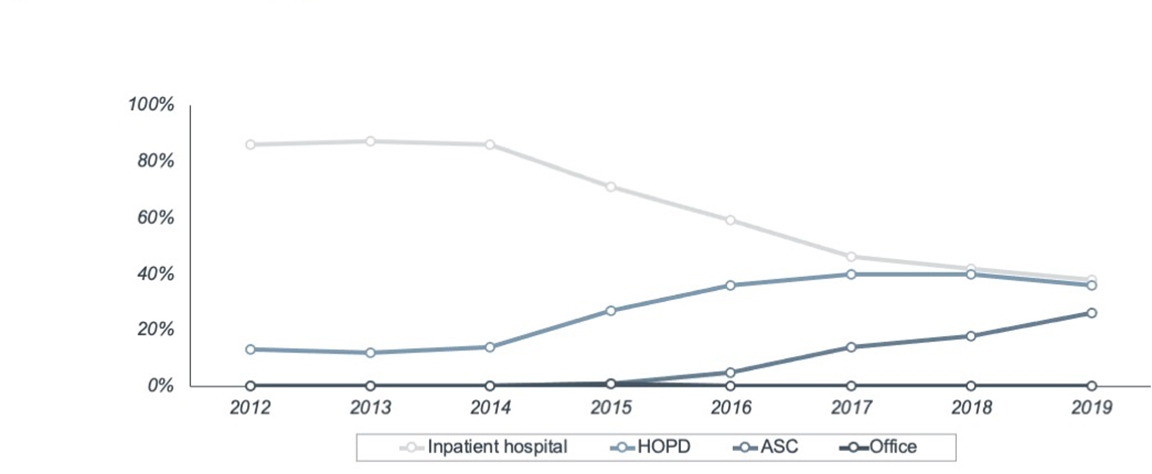

We attribute this variation in ASC market share growth to the presence, or lack thereof, various market forces. Take SI joint fusion as an example, which was approved for ASC reimbursement in 2015. Immediately following approval, inpatient Medicare volumes dropped dramatically while ASC share, represented in the graph below by the darker line, experienced strong growth.

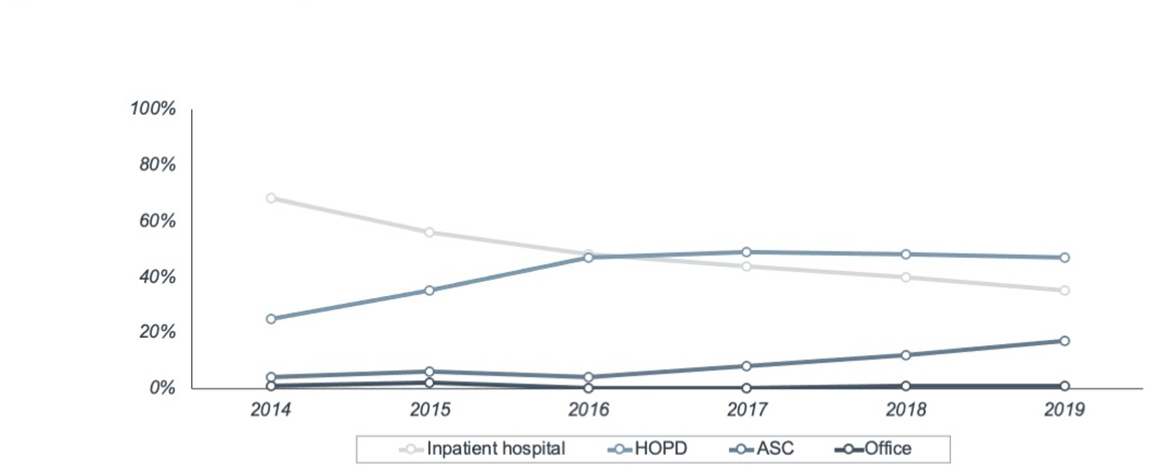

Share of annual volumes by each major care site for SI joint fusion

Medicare Fee-for-Service; data represents share of annual volumes treated at each major care site

Share of annual volumes by each major care site for SI joint fusion

Optum’s de-identified Clinformatics® Data Mart Database; data represents share of annual volumes treated at each major care site

Orthopedic specialists have a higher degree of independence from health systems and more frequently own stakes in ASCs than physicians in other service lines, creating a financial incentive to treat patients outside of the hospital. Many SI joint fusions also carry fewer clinical risks than spinal fusion procedures, which did not see a similarly dramatic drop in inpatient volume share from 2014 to 2019, and the procedure requires few additional investment in procedural infrastructure for delivery in the ASC. These factors that set SI joint fusion apart predate regulatory approval for moving the procedure to outpatient. So, the approval may have triggered the (relatively simple) shift to the ASC.

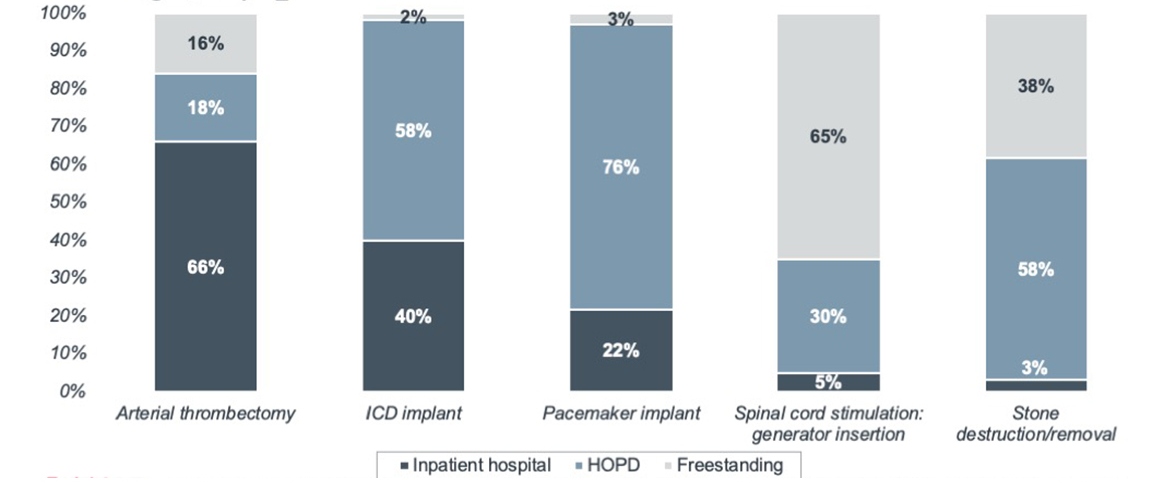

We saw similar variation in long-term shifts after regulatory approval. The graph below shows the current site-of-care distribution for procedures eligible for Medicare ASC reimbursement before 2013.

Share of 2019 Clinformatics® volumes across care settings, by procedure

Optum’s de-identified Clinformatics® Data Mart set; data represents procedures approved for ASC before 2013

Notably, freestanding share of volumes remained low for the three cardiovascular procedures (arterial thrombectomy, ICD implant, and pacemaker implant), despite at least seven years of ASC eligibility by 2019. This slow shift to freestanding sites is likely due to market barriers such as high costs in cardiac catheterization lab infrastructure, the need for specialized staff, and the strong degree of physician employment and affiliation with hospital-based systems. Accelerated shift of these procedures would require a change in one or more of these market conditions.

While procedures tend to shift slowly across care settings, rapid shift can happen when regulatory and market forces align.

Stakeholders looking to maintain their share of procedure volumes should monitor local market forces to anticipate change. And stakeholders looking to spark shift to lower-cost care settings should take an active role in shaping the market forces that (along with regulation) enable and sustain outpatient shift.

- Health system providers hold strong procedure market share despite regulatory changes, but this trend won’t necessarily continue indefinitely. To preserve current market share, systems need to incorporate freestanding ownership or partnership options into investment conversations.

- Independent providers are driving volumes to the freestanding setting. To further capitalize on this trend, independent providers need to lead the market in offering consumer more access points for procedure care.

- Payers have traditionally relied on payment incentives to drive volumes to the freestanding setting. But slow growth for most procedures shows that this lever isn’t enough. To accelerate the site-of-care shift, payers must preserve specialist independence and partner with operators to build the necessary infrastructure.

- Suppliers and service providers have new potential clients in the form of physicians and ambulatory operators who can provide procedural care independent of hospital partners. When evaluating new capital investments, physicians and ambulatory providers are more likely to prioritize cost containment and throughout efficiency than traditional providers.

Don't miss out on the latest Advisory Board insights

Create your free account to access 1 resource, including the latest research and webinars.

Want access without creating an account?

You have 1 free members-only resource remaining this month.

1 free members-only resources remaining

1 free members-only resources remaining

You've reached your limit of free insights

Become a member to access all of Advisory Board's resources, events, and experts

Never miss out on the latest innovative health care content tailored to you.

Benefits include:

You've reached your limit of free insights

Become a member to access all of Advisory Board's resources, events, and experts

Never miss out on the latest innovative health care content tailored to you.

Benefits include:

This content is available through your Curated Research partnership with Advisory Board. Click on ‘view this resource’ to read the full piece

Email ask@advisory.com to learn more

Click on ‘Become a Member’ to learn about the benefits of a Full-Access partnership with Advisory Board

Never miss out on the latest innovative health care content tailored to you.

Benefits Include:

This is for members only. Learn more.

Click on ‘Become a Member’ to learn about the benefits of a Full-Access partnership with Advisory Board

Never miss out on the latest innovative health care content tailored to you.